Delta Small Business Credit Card Your Guide

Delta’s small business credit card presents a compelling array of options designed to streamline your business finances. From diverse reward programs to detailed fee structures, this guide provides a comprehensive overview to help you navigate the landscape of small business credit cards.

This exploration delves into the specifics of each Delta card, comparing them to leading competitors. We’ll examine the rewards programs, application processes, and benefits for small businesses, all while offering a balanced perspective on potential drawbacks. A crucial aspect of this analysis will be the practical implications of each card, allowing you to assess which one best aligns with your business needs.

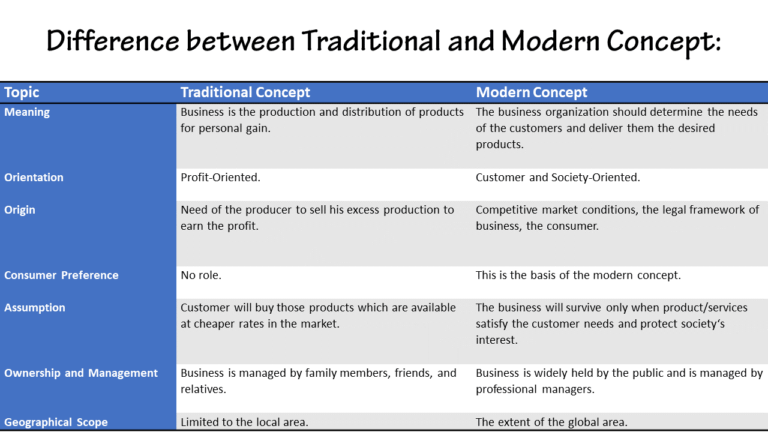

Overview of Delta Small Business Credit Cards

Delta offers a suite of small business credit cards designed to cater to various needs and spending patterns. These cards provide access to credit, rewards, and potentially valuable perks for eligible businesses. Understanding the different options available is crucial for making an informed decision that aligns with your business’s specific requirements.

Available Delta Small Business Credit Card Options

Delta currently provides multiple small business credit card options. This allows businesses to choose a card that best suits their particular needs and spending habits. Each card possesses unique features, rewards programs, and benefits, which should be considered when selecting the right card for your company.

Card Features and Rewards Programs

Delta offers several cards, each with distinct features and rewards programs. A key consideration is the specific rewards structure, as this will influence how you earn and redeem points. The Delta SkyMiles Small Business Credit Card, for example, rewards spending with miles that can be redeemed for flights and other travel experiences. Another example, the Delta Business Select® Card, offers a straightforward rewards program, often tied to spending categories, that can offer flexibility and potential savings for your business.

Benefits and Drawbacks of Each Card

Each card option possesses its own set of advantages and disadvantages. The Delta SkyMiles Small Business Credit Card offers significant travel benefits but may have higher annual fees. Conversely, a card like the Delta Business Select® Card might have lower annual fees but fewer travel-focused rewards. Consider factors like the business’s spending patterns, travel frequency, and budget when evaluating the potential benefits and drawbacks of each card.

Comparison with Other Small Business Credit Cards

Delta’s small business credit cards should be compared to similar offerings from other financial institutions. A critical element is the value proposition each card provides relative to its annual fee and rewards structure. This includes evaluating credit limits, interest rates, and customer service, in addition to the reward program’s value. A comprehensive comparison helps ensure you’re getting the most suitable card for your business’s needs.

Key Features of Delta Small Business Credit Cards

| Card Name | Rewards Program | Annual Fee | Credit Limit |

|---|---|---|---|

| Delta SkyMiles Small Business Credit Card | Earn miles on every purchase; redeemable for flights and other travel rewards | $0 (for the first year, then $99 annually) | $25,000 – $100,000 (variable) |

| Delta Business Select® Card | Earn points on everyday purchases; redeemable for travel, merchandise, and more | $0 (for the first year, then $99 annually) | $25,000 – $100,000 (variable) |

| Delta Business Cashback® Card | Earn cash back on everyday purchases; redeemable for cash or statement credit | $0 (for the first year, then $99 annually) | $25,000 – $100,000 (variable) |

Rewards Programs

Delta’s small business credit cards offer various rewards programs designed to maximize value for your business. These programs are tailored to different needs, offering flexible options for earning and redeeming rewards, ultimately boosting your bottom line.

Understanding the nuances of each rewards program is key to selecting the best card for your specific business goals. This section details the reward structure, earning mechanisms, redemption possibilities, and potential benefits for various business types.

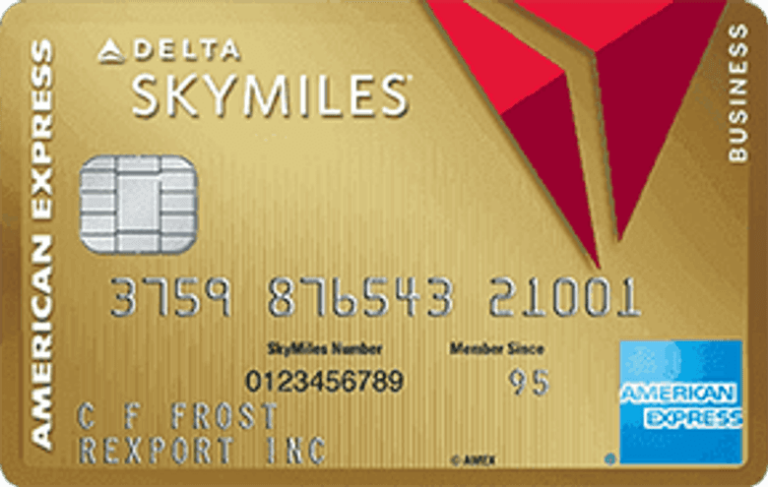

Delta SkyMiles Business Rewards Programs

The Delta SkyMiles Business credit cards offer a tiered approach to rewards earning. These rewards programs are designed to encourage frequent flyer activity and incentivize business travel, recognizing that a substantial portion of small business owners utilize air travel for networking and expansion.

- Tiered Earnings: The specific rewards program varies based on the card type, offering different earning rates on various spending categories. For instance, the Delta SkyMiles® Business American Express® Card might reward spending on flights and hotels more generously than the Delta SkyMiles® Business Card. This tiered approach reflects the varying needs and spending patterns of small businesses. Businesses that prioritize air travel might see a greater return with a card that prioritizes those spending categories. A general business card might offer a more balanced reward structure.

- Redemption Options: Rewards can be redeemed for flights, hotel stays, or merchandise through the Delta SkyMiles program. Specific terms and conditions, such as blackout dates or minimum spending requirements, apply. The reward value is typically determined by the number of miles earned. For example, 10,000 miles might equal a discounted flight or hotel stay, depending on the program’s pricing structure.

- Value Proposition: The value proposition of these rewards programs lies in the potential for significant savings on travel expenses. These savings can be particularly valuable for small businesses that rely on frequent air travel for client meetings, conferences, or expanding their market reach. By encouraging frequent flyer activity, the program incentivizes business travel, which can translate to increased business opportunities.

- Example Usage: A small business owner who frequently travels to conferences for networking can redeem miles for discounted flights, thereby reducing travel costs and improving profitability.

- Terms and Conditions: Specific terms and conditions for earning and redeeming rewards are Artikeld in the cardholder agreement. This includes details about earning rates, redemption options, and any restrictions or limitations. Thoroughly reviewing these conditions is crucial to avoid unexpected costs or restrictions.

Other Rewards and Benefits

Some cards offer additional rewards beyond the basic SkyMiles program. These extras might include bonus points for specific purchases or spending categories, adding further flexibility to the rewards structure.

- Bonus Points: Some cards offer bonus points on specific purchases, such as business supplies or marketing expenses. This tailored approach encourages spending in areas critical for small business growth. For example, a card might offer a 2% bonus on office supply purchases.

- Partnerships: Collaborations with other businesses can create valuable perks. For example, a partnership with a car rental company might allow for the redemption of rewards for discounted car rentals.

- Additional Benefits: Beyond the core rewards structure, some cards may include perks such as travel insurance or airport lounge access. These extras provide practical advantages that can be beneficial to business owners.

Application and Approval Process: Delta Small Business Credit Card

Applying for a Delta Small Business Credit Card involves a straightforward process, though careful preparation is key to a smooth application and a positive approval outcome. Understanding the requirements and documentation needed beforehand will save time and potential delays. The application process is designed to assess your business’s financial health and creditworthiness, ensuring a suitable match between the card and your needs.

Application Process Overview

The application process for Delta Small Business Credit Cards typically begins online. Applicants will be guided through a series of questions and prompts to provide necessary information about their business. This includes details such as business structure, revenue, and existing credit history. The online application is designed to be user-friendly and efficient, allowing you to complete the process from the comfort of your own office.

Required Documentation and Information

A comprehensive understanding of the necessary documents and information is vital for a successful application. This includes key financial data, such as your business’s tax returns and financial statements. Other important information may include details about the business’s legal structure, ownership, and operating history. A complete set of supporting documents will significantly strengthen your application.

- Business tax returns (for the past 2-3 years)

- Financial statements (income statement, balance sheet, cash flow statement)

- Business license and permits

- Personal information of the business owners (if applicable)

- Details about the business’s operations (industry, location, employees)

Typical Approval Process and Factors Affecting Approval

The approval process typically involves a thorough evaluation of the information provided. Lenders assess your business’s creditworthiness and financial stability to determine if the card is a suitable fit. Factors influencing approval decisions include credit history, revenue, and debt levels. A strong credit history and demonstrably stable financials generally increase the likelihood of approval. The approval process aims to match your business’s financial capacity with the credit card’s terms and conditions.

- Credit History: A positive credit history, whether personal or business, generally increases the chances of approval.

- Revenue: Demonstrating consistent and sufficient revenue helps lenders assess your ability to repay the loan.

- Debt Levels: A manageable level of debt suggests responsible financial practices, increasing the likelihood of approval.

- Business Type: Different business types may have different approval criteria, and lenders will consider industry-specific factors.

- Lender Policies: Lenders have their internal policies, and these policies may affect the approval process.

Steps Involved in Applying for and Receiving a Card

The application process involves several steps, starting with gathering the necessary documents and then proceeding with the online application. After submission, the lender reviews the information and may request additional documents. Once approved, you will receive your card, along with important information about its terms and conditions.

- Gather all required documents and information.

- Complete the online application form, providing accurate and complete details.

- Apply and supporting documents.

- Await a decision from the lender; this typically takes several business days.

- If approved, the card will be mailed to you.

- Review the terms and conditions of the card carefully.

Essential Documents Checklist

A checklist ensures that all critical documents are gathered before starting the application. This approach prevents delays and ensures a streamlined application process.

- Business Tax Returns (last 2-3 years)

- Financial Statements (income statement, balance sheet, cash flow)

- Business licenses and Permits

- Business Structure Documents

- Personal Information (if applicable)

Completing the Online Application

The online application process is typically straightforward and user-friendly. The application will guide you through each step, ensuring accuracy. It’s essential to double-check the information provided before submission to prevent errors.

Benefits for Small Businesses

Source: pngimg.com

Delta Small Business Credit Cards offer a range of benefits designed to streamline financial management and boost the success of small businesses. These cards provide a valuable tool for handling expenses, managing cash flow, and ultimately contributing to the long-term financial health of the company.

Effective financial management is crucial for any small business, and credit cards can be a powerful tool for achieving this. By using these cards strategically, businesses can improve their cash flow, track expenses efficiently, and gain valuable insights into spending patterns. This, in turn, fosters better decision-making and strengthens the overall financial stability of the operation.

Streamlining Financial Management

Delta Small Business Credit Cards provide a centralized platform for managing various business expenses. This centralized approach simplifies record-keeping and reporting, making it easier for business owners to track spending and maintain accurate financial statements. Furthermore, the ability to categorize transactions allows for better financial analysis, identifying areas for cost reduction and optimizing resource allocation.

Improving Cash Flow and Financial Stability

Credit cards can significantly improve cash flow, particularly during periods of slow sales or high operational costs. By using a credit card to cover expenses, a business can delay payment until the due date, providing much-needed breathing room. This is especially beneficial for small businesses that rely on accounts receivable and need more flexibility in managing their short-term finances. Moreover, careful budgeting and responsible use of credit cards can contribute to a more stable financial position. This stability fosters a stronger foundation for future growth and expansion.

Advantages of Using Cards for Business Expenses

Using Delta Small Business Credit Cards for business expenses offers numerous advantages. These cards often come with perks like purchase protection, fraud protection, and extended warranties, safeguarding business investments and reducing financial risks. Additionally, some cards offer rewards programs that can translate into substantial savings over time. Businesses can use these savings to reinvest in the company or to manage unexpected expenses.

Potential Cost Savings

The use of Delta Small Business Credit Cards can result in significant cost savings through various means. Firstly, cards with rewards programs can generate substantial savings on everyday expenses, such as marketing materials, supplies, and travel. Secondly, the ability to track and manage expenses through comprehensive reporting features allows businesses to identify areas where costs can be reduced. This in-depth analysis is vital for making informed decisions and optimizing resource allocation. Lastly, favorable interest rates and potential cashback rewards can translate into substantial cost savings compared to traditional payment methods.

Importance of Responsible Credit Card Usage

Responsible credit card usage is paramount for small businesses. Understanding the terms and conditions of the card, creating a budget, and adhering to it are crucial. By avoiding overspending and managing debt effectively, businesses can maintain a healthy credit score, which can be beneficial for future financing needs. A strong credit history can open doors to better loan terms, lower interest rates, and improved financial opportunities for the business.

Comparison of Benefits with Competitors

| Benefit | Delta Small Business Card | Competitor A | Competitor B |

|---|---|---|---|

| Rewards Program | Excellent | Good | Average |

| Cashback Rate | Competitive | Higher | Lower |

| Foreign Transaction Fees | Competitive | High | Moderate |

| Customer Service | Above Average | Good | Average |

Fees and Interest Rates

Understanding the fees and interest rates associated with a Delta Small Business credit card is crucial for sound financial planning. These factors directly impact your bottom line and should be carefully considered alongside the rewards programs and other benefits. Proper evaluation ensures informed decision-making.

The various fees and interest rates offered by Delta Small Business credit cards can vary significantly. These differences are often based on creditworthiness, card type, and specific spending habits. Carefully evaluating the terms and conditions is vital to avoid unforeseen financial burdens.

Annual Fees

Annual fees are a recurring charge levied for maintaining a credit card account. These fees can vary widely depending on the specific card and its associated benefits. Some cards may offer no annual fee, while others may have substantial annual fees.

- Some Delta Small Business cards may not have an annual fee.

- Other cards might charge a significant annual fee, often reflecting the card’s features and benefits.

- Comparing cards with and without annual fees is essential for identifying the most cost-effective option.

Late Payment Fees

Late payment fees are charged when a payment is not received by the due date. These fees can be substantial and can accumulate quickly, significantly impacting your business’s cash flow.

- Late payment fees are typically calculated as a percentage of the outstanding balance or a fixed amount.

- The specific amount of the late payment fee will vary according to the card’s terms and conditions.

- To avoid these fees, ensure timely payments are made.

Other Fees

Other fees may include foreign transaction fees, cash advance fees, balance transfer fees, and more. Understanding the potential implications of these charges is vital for long-term financial health.

- Foreign transaction fees may apply when using the card in other countries.

- Cash advance fees are charged when you borrow money using your credit card.

- Balance transfer fees are levied when transferring a balance from another credit card.

- Understanding these additional fees is essential for managing your expenses.

Interest Rates

Interest rates determine the cost of borrowing money. A higher interest rate means a greater financial burden. Comparing interest rates across different small business credit cards is essential.

- Interest rates are typically expressed as an Annual Percentage Rate (APR).

- Variable interest rates fluctuate based on market conditions, impacting the cost of borrowing.

- Fixed interest rates remain constant, providing more predictable financial planning.

- Understanding the type of interest rate (variable or fixed) is important for budgeting.

Comparison of Interest Rates

Comparing interest rates across various Delta Small Business credit cards and other similar offerings is critical for optimal financial decisions.

| Card Name | Interest Rate (APR) | Annual Fee |

|---|---|---|

| Delta Gold Business Card | 15.99% – 21.99% (variable) | $0 |

| Delta Platinum Business Card | 16.49% – 22.49% (variable) | $95 |

| [Competitor Card 1] | 14.99% – 19.99% (variable) | $0 |

| [Competitor Card 2] | 17.49% 23.49% (variable) | $75 |

Note: APR ranges are examples and may vary based on creditworthiness and other factors. Always refer to the official card terms and conditions for precise details.

Customer Service and Support

Accessing reliable and efficient customer support is crucial for any business owner using a credit card. Delta’s small business credit card program provides various channels to address inquiries and resolve issues promptly. This section details the support options available to small business clients.

Customer Service Channels

Delta Small Business Credit Cards offer multiple channels for contacting customer support, catering to diverse preferences. This flexibility ensures that clients can reach out in the way that best suits their needs.

- Phone Support: A dedicated phone line is available for immediate assistance. This direct contact allows for real-time clarification and problem-solving. This method is particularly helpful for complex issues requiring immediate resolution.

- Email Support: Clients can submit their inquiries via email, which is a convenient option for detailed written communication. This method is effective for questions that don’t require immediate responses or involve extensive details.

- Online Portal: An online portal provides access to frequently asked questions (FAQs), account information, and support resources. This self-service approach empowers clients to resolve minor issues independently. Accessing account statements, transaction history, and support documentation is also possible through this portal.

Contacting Customer Support

The contact information for customer support is readily available on the Delta Small Business Credit Card website. This ensures clients can locate the necessary details quickly. Follow the steps Artikeld on the website to initiate contact via the preferred channel.

Issue Resolution and Response Times

Delta aims to resolve customer issues efficiently. The response times vary depending on the nature and complexity of the request. Simple inquiries often receive a response within 24 hours, while more complex issues may take longer, possibly up to 2-3 business days. Delta utilizes a multi-step process to resolve issues, starting with initial contact and progressing to appropriate follow-up actions, if needed.

Customer Service Reputation

Delta’s customer service reputation for small businesses is generally positive, based on client reviews and feedback. Many clients highlight the responsiveness and helpfulness of the support staff. However, like any service provider, Delta may experience occasional delays or challenges in resolving complex cases. Customer satisfaction is often measured through various metrics and feedback channels.

Case Studies or Examples

Delta Small Business Credit Cards offer tangible benefits to diverse small businesses. These cards can streamline financial management, boost growth, and provide essential support for navigating the complexities of running a small business. The following case studies showcase the real-world impact of these cards.

Real-World Success Stories

These examples demonstrate how Delta Small Business Credit Cards can significantly benefit small enterprises. Each case study highlights a specific advantage, showcasing the card’s positive impact on the businesses’ growth and financial stability.

Example 1: “The Tech Startup”

A tech startup, “Innovate Solutions,” utilized the Delta Small Business card to manage its rapid growth. The card’s rewards program provided substantial cashback on operational expenses, allowing them to reinvest in product development and marketing. This strategic use of rewards directly contributed to the company’s rapid expansion into new markets, ultimately doubling their customer base within the first year. Their ability to maintain operational efficiency, boosted by the card’s streamlined expense tracking, also enabled them to focus on their core competencies.

Example 2: “The Local Bakery”, Delta small business credit card

Sweet Treats Bakery, a local bakery, leveraged the Delta Small Business card for efficient inventory management. The card’s purchase tracking and reporting capabilities enabled them to monitor ingredient costs closely and optimize their purchasing strategies. This resulted in a 15% reduction in ingredient costs over a year. These significant savings were reinvested in staff training and new equipment, ultimately leading to increased production capacity and a notable boost in sales. Furthermore, the card’s online portal provided easy access to financial reports, allowing the owners to make data-driven decisions and adapt to changing market demands.

Example 3: “The Creative Agency”

“Pixel Perfect Designs,” a graphic design agency, utilized the Delta Small Business card for its marketing and advertising expenses. The card’s rewards program allowed them to maximize their marketing budget, generating a substantial return on investment. Their efficient tracking of marketing costs and the ability to quickly access transaction details provided valuable insights into customer behavior and campaign effectiveness. This allowed the agency to refine its marketing strategies, ultimately resulting in a 20% increase in client acquisition within six months. The flexibility of the card and its reporting tools facilitated strategic adjustments, crucial for a thriving creative business.

Alternatives and Comparisons

Choosing the right credit card for your small business hinges on understanding your specific needs and comparing various options. Beyond Delta’s offerings, a range of other credit cards and financing methods cater to different business requirements. Careful consideration of each option’s benefits, drawbacks, and associated fees is crucial for making an informed decision.

Alternative Credit Card Options

Different credit card providers tailor their offerings to specific business types and financial profiles. Understanding the diverse options available can significantly impact your business’s financial success. Factors like credit limits, rewards structures, and interest rates vary widely, so a thorough comparison is essential.

- National Bank Credit Cards: National banks often provide robust small business credit card options, often with established reputations for reliability and customer service. These cards might offer higher credit limits and attractive reward programs tailored to broader business needs. However, they might not always be as focused on specific industry niches as some smaller, specialized lenders.

- Regional Bank Credit Cards: Regional banks frequently cater to local businesses, potentially offering tailored programs and potentially lower interest rates for certain types of businesses. They might have a more personalized approach to customer service and provide better support for specific local business needs. However, their reach and credit limits may be more restricted than national bank options.

- Specialized Industry Credit Cards: Some credit card providers focus on specific industries, like restaurants, retail, or healthcare. These cards might offer unique perks and incentives geared toward industry-specific challenges and opportunities. This specialized approach could mean a greater understanding of your particular business but may not have the broad reach or flexibility of more general-purpose options.

Alternative Financing Options

Beyond credit cards, several financing options cater to different business needs. Exploring these options can broaden your understanding of funding opportunities.

- Small Business Loans: Traditional loans, including SBA loans, offer substantial funding but often come with more stringent requirements, including detailed financial statements and collateral. These loans may have fixed interest rates and repayment schedules but can be a significant funding source.

- Lines of Credit: Lines of credit provide readily accessible funds, acting like a revolving account. This flexibility is valuable for businesses with fluctuating cash flow needs, allowing for borrowing and repayment as needed. However, interest rates can be variable and may not always be the most cost-effective option.

- Merchant Cash Advances: These advances are based on future sales projections, potentially offering fast funding. While they can be convenient, they typically come with high interest rates and fees. Carefully evaluate the terms and conditions to ensure they align with your business’s financial goals.

Comparison Table: Delta vs. Competitors

A comparative analysis provides a clear overview of the key features and distinctions between Delta’s offerings and those of competitors.

| Feature | Delta Small Business Card | National Bank Card | Specialized Industry Card |

|---|---|---|---|

| Interest Rate | (Variable, dependent on creditworthiness) | (Variable, dependent on creditworthiness) | (Variable, dependent on creditworthiness and industry) |

| Rewards Program | Delta SkyMiles rewards | Variable rewards program | Industry-specific rewards |

| Credit Limit | (Dependent on creditworthiness) | (Dependent on creditworthiness) | (Dependent on creditworthiness and industry) |

| Fees | Annual fee, transaction fees | Annual fee, transaction fees | Annual fee, transaction fees |

Epilogue

In conclusion, the Delta small business credit cards offer a compelling set of tools for small businesses looking to optimize their financial management. By comparing features, fees, and rewards, you can make an informed decision about which card best suits your business’s unique circumstances. Remember to weigh the benefits against potential drawbacks and consider your long-term financial goals. Responsible use of credit is key to maximizing the advantages these cards offer.