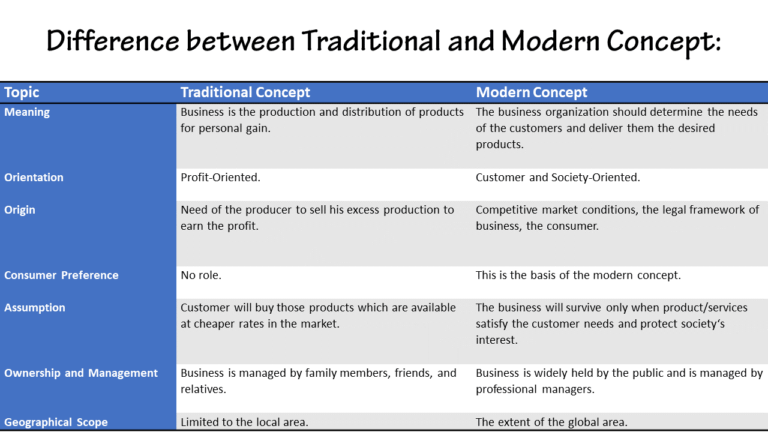

Delta SkyMiles Business Card A Deep Dive

Delta SkyMiles Business Card sets the stage for a comprehensive exploration of its features, benefits, and potential drawbacks. This in-depth analysis will cover everything from eligibility requirements and reward structures to practical tips for maximizing its value, alongside comparisons to other business travel cards.

The card’s unique rewards program, potential travel perks, and application process will be thoroughly examined, allowing readers to make informed decisions about whether this card aligns with their business travel needs. We’ll also explore potential limitations and hidden fees, ensuring a complete understanding of the card’s value proposition.

Overview of Delta SkyMiles Business Card

The Delta SkyMiles Business Card offers valuable rewards and travel benefits specifically designed for business travelers. It’s a credit card that leverages Delta’s extensive network to maximize your travel experience while earning significant miles. This card is a compelling option for frequent fliers seeking enhanced travel perks and rewards.

Key Benefits and Features

The Delta SkyMiles Business Card boasts a range of attractive features designed to enhance the travel experience for business professionals. These features often include generous earning rates on eligible purchases, expedited check-in and security benefits, and access to Delta’s exclusive lounges.

| Benefit | Description | Eligibility Criteria |

|---|---|---|

| Enhanced Earning Rates | Earn SkyMiles at an accelerated rate on eligible purchases, often exceeding standard earning rates on other cards. | Generally, meeting minimum spending requirements on the card and maintaining a good credit history. |

| Priority Boarding | Enjoy priority boarding on Delta flights, saving time and allowing for more comfortable travel arrangements. | Typically, this benefit is associated with reaching certain SkyMiles earning tiers or cardholder status levels. |

| Delta SkyClub Access | Gain access to Delta SkyClub lounges at participating airports for relaxation and work opportunities during your travels. | Often tied to achieving specific SkyMiles status levels or cardholder qualifications. |

| Exclusive Perks | Access to exclusive perks and benefits not available to standard cardholders, like expedited check-in or special service options. | Often depends on meeting minimum spending requirements, achieving specific SkyMiles status levels, or demonstrating consistent use of the card. |

| Travel Insurance Options | Potential coverage for trip disruptions, baggage delays, and other travel mishaps, with variable coverage based on specific card terms. | Eligibility varies by specific plan and the policy conditions. |

Eligibility Requirements

Obtaining the Delta SkyMiles Business Card involves meeting specific criteria to qualify for the card. These requirements usually encompass factors like credit history, income, and spending habits.

- A strong credit history, demonstrated through a positive credit report, is typically a prerequisite for securing the card. This often involves a good credit score.

- Meeting minimum income thresholds, as set by the issuer, can be a component of the eligibility process.

- Fulfillment of spending requirements set by the issuer may be necessary to maintain the card benefits or access certain perks.

Common Misconceptions

Some common misconceptions surrounding the Delta SkyMiles Business Card include overestimating the value of the rewards or the ease of meeting eligibility requirements. A thorough understanding of the card’s terms and conditions is essential to avoid any potential disappointment.

- It’s crucial to understand that the value of earned SkyMiles depends on how and when they are redeemed. A detailed understanding of redemption options and associated costs is essential.

- Meeting the minimum spending requirements for maintaining benefits may not always be straightforward, particularly during periods of low spending. Thorough review of the spending requirements and policy terms is critical.

- The availability of perks, such as priority boarding, can be subject to changes based on flight availability and specific policy conditions. Checking the terms and conditions of the policy is important.

Comparison with Other Business Cards

Choosing the right business travel credit card hinges on aligning your travel preferences and spending habits with the card’s benefits. Comparing the Delta SkyMiles Business Card against competitors illuminates the strengths and weaknesses of each option. Understanding the reward structures and associated fees is crucial for making an informed decision.

Reward Structures and Points Earning

Different business travel cards employ varying reward structures, impacting how quickly you accumulate points and redeem them for travel. Some cards focus on maximizing points earned on specific spending categories, while others offer broader reward potential across various expenses. The Delta SkyMiles Business Card, for example, often prioritizes earning points on travel-related purchases. A key aspect is evaluating the earning rates on different spending categories, as these can significantly affect the overall value proposition.

Annual Fees and Benefits

Annual fees and travel benefits are key factors in determining the true cost and value of a business travel card. The Delta SkyMiles Business Card, like its competitors, has an associated annual fee. Understanding this fee about the offered benefits, such as elite status, complimentary upgrades, and lounge access, is essential. Comparing annual fees and associated benefits across multiple cards provides a more comprehensive perspective on the overall value proposition.

Comparison Table

| Card Name | Reward Structure | Annual Fee | Travel Benefits |

|---|---|---|---|

| Delta SkyMiles Business Card | Earn miles on Delta flights and eligible Delta partners with various spending categories. Points can be redeemed for flights, hotels, and other travel experiences. | Typically $95-$195 (depending on specific card offerings) | Potential for Delta SkyMiles Medallion status, which unlocks perks like priority boarding, lounge access, and more. May include complimentary checked bags and other perks. |

| American Express Platinum Card (Business) | Earn Membership Rewards points on a broad range of spending categories, including travel, dining, and entertainment. Points can be transferred to various airline and hotel programs. | $695 | Extensive travel benefits, including premium airport lounge access, travel insurance, and Global Entry/TSA PreCheck benefits. |

| Chase Sapphire Preferred Card (Business) | Earn points on travel, dining, and other purchases. Points can be redeemed for travel through various programs and also transferred to other partners. | $195 | Attractive travel benefits, including purchase protection and travel accident insurance, along with a robust travel credit structure. |

Key Considerations

The most suitable business travel card depends on your specific travel needs and spending patterns. Consider factors like your desired level of elite status, frequency of travel, and preferred airline partners. Careful evaluation of the reward structures, annual fees, and travel benefits is critical for maximizing the value of your chosen card. For instance, a frequent Delta flyer might find the Delta SkyMiles Business Card a compelling option.

Rewards and Benefits

The Delta SkyMiles Business Card rewards program offers substantial value for frequent business travelers. Understanding the earning structure and redemption options is crucial for maximizing the benefits and achieving optimal value. This section details the rewards program, strategies for maximizing rewards, and the earning and redemption process.

The Delta SkyMiles program, encompassing a broad range of travel benefits, provides flexibility and rewards for various travel preferences. The card’s earning potential is directly linked to spending and travel activities, allowing cardholders to accumulate miles efficiently.

Rewards Earning Structure

The earning structure is based on spending categories. Each dollar spent in eligible categories earns a predetermined number of miles. This structured approach allows for targeted accumulation of miles, reflecting the cardholder’s spending habits. For example, spending on flights and hotels within the Delta network will earn more miles compared to general spending. Consistent spending on business-related activities like travel and accommodations maximizes earning potential.

Redemption Options

Delta SkyMiles offers diverse redemption options for flights, hotel stays, and other travel-related expenses. Miles can be redeemed for award flights on Delta and partner airlines or hotel stays at participating hotels. This flexibility ensures a wide range of redemption possibilities. Specific redemption rates and availability are subject to change, so it is important to check current information on Delta’s website or app.

Maximizing Rewards and Benefits

To maximize the rewards and benefits, travelers should actively participate in the program’s promotions and utilize the available tools for tracking and managing their miles. Careful planning and utilizing the Delta app or website to track miles earned and redeem them for desired travel arrangements are key. Utilizing bonus offers for travel purchases can substantially increase the overall value of the rewards earned.

Travel Perks and Exclusive Access

The card often comes with additional perks beyond the basic miles earning structure. These perks may include priority boarding, access to Delta Sky Clubs, or other exclusive benefits for Delta SkyMiles members. These exclusive benefits enhance the overall travel experience, particularly for frequent flyers. A well-defined understanding of these perks allows for a personalized and maximized travel experience.

Reward Earning and Redemption Process Flowchart

Application and Card Management

Securing and managing your Delta SkyMiles Business Card is straightforward. The application process is designed for efficiency, and robust online tools facilitate card management. Understanding these procedures ensures you maximize the card’s benefits.

Applying for the Delta SkyMiles Business Card

The application process for the Delta SkyMiles Business Card is generally accessible through Delta’s online platform. Applicants will need to provide specific details, including personal information, business details, and financial information.

- Visit the Delta SkyMiles Business Card application page on Delta’s website.

- Gather the necessary documentation, including business tax information, such as tax ID or employer identification number, and personal details like social security number.

- Complete the online application form, providing accurate and up-to-date information. Double-check all entered data for any errors.

- Review the application summary and submit it once you are satisfied with the information.

- Awaiting approval is a normal part of the process. Delta will notify you of the status of your application via email.

Card Management Process

Managing your Delta SkyMiles Business Card is simplified through a dedicated online account. This account allows for viewing and managing your rewards, flight bookings, and other essential details.

- Access your Delta SkyMiles Business Card account online via Delta’s website.

- Update your account information, including contact details and business information, as needed.

- Review your rewards balances and recent activity.

- Track and manage your booked flights and any accumulated miles.

- Utilize online tools for adjusting preferences and managing your profile details.

Online Account Tools

Delta provides a range of online tools to facilitate card management. These tools allow you to monitor account activity, make changes, and access relevant information promptly.

- Account dashboard: A comprehensive view of your account activity, rewards, and any pending transactions.

- Transaction history: Detailed records of all your activities, enabling you to track spending and rewards earned.

- Statement access: Access to your transaction statements for easy reference and record keeping.

- Profile management: Update personal and business information to maintain accuracy and facilitate smooth transactions.

Mobile App Features

The Delta SkyMiles mobile application provides a convenient platform for managing your business card on the go.

- Account access: View your account balance, rewards, and recent activity from anywhere.

- Flight tracking: Monitor flight status and manage your booked flights easily.

- Mobile check-in: Simplify the check-in process at the airport through the app.

- Rewards tracking: Monitor your miles earned and track your progress towards rewards.

- Push notifications: Receive timely alerts on important account updates.

Reporting Lost or Stolen Cards

Delta’s reporting process for lost or stolen cards is crucial for maintaining security.

- Contact Delta’s customer service immediately to report the lost or stolen card.

- Provide accurate details about the card and any circumstances surrounding the loss or theft.

- Request a temporary suspension or cancellation of the card to prevent unauthorized use.

- Follow the specific instructions provided by Delta’s customer service representatives.

Potential Drawbacks and Considerations

While the Delta SkyMiles Business Card offers attractive rewards, potential drawbacks and careful consideration are crucial before application. Understanding the limitations, associated fees, and terms and conditions will help you determine if this card aligns with your travel and spending habits.

Careful evaluation of the annual fee’s impact on the overall value proposition and potential hidden charges is essential for a balanced perspective. Understanding the terms and conditions related to the card will empower you to make an informed decision.

Annual Fee

The annual fee is a significant factor influencing the card’s value proposition. A high annual fee can quickly diminish the rewards earned, especially if you don’t travel frequently or utilize the card extensively for business-related expenses. For example, if the annual fee exceeds the potential savings in rewards, the card might not be financially beneficial. Consider your anticipated travel frequency and spending habits when assessing the impact of the annual fee.

Hidden fees

Scrutinize the card’s terms and conditions for any hidden fees or charges. These might include foreign transaction fees, balance transfer fees, or inactivity fees. It’s crucial to identify these potential charges upfront to avoid unexpected costs. A comprehensive review of the fine print is recommended to ensure a clear understanding of all associated costs.

Terms and Conditions

Review the complete terms and conditions carefully. This document Artikels the rules and regulations governing the card’s use, including reward redemption policies, eligibility requirements, and any restrictions on travel or spending. Thorough examination of the fine print is essential for clarity and to avoid misunderstandings.

Potential Drawbacks Summary

| Potential Drawback | Explanation | Impact |

|---|---|---|

| High Annual Fee | The annual fee can significantly reduce the overall value proposition if the rewards earned don’t offset the cost. | Reduces profitability if travel frequency is low. |

| Hidden Fees | Potential for unforeseen charges like foreign transaction fees, balance transfer fees, or inactivity fees. | Can significantly impact the budget if not anticipated. |

| Redemption Restrictions | Certain restrictions on reward redemption might limit the flexibility of the program. | Reduced options for reward usage, especially in terms of destinations or airlines. |

| Strict Eligibility Criteria | Meeting specific eligibility requirements might be challenging. | Difficulty in obtaining the card if not meeting the prerequisites. |

Customer Service and Support

The Delta SkyMiles Business Card, like any financial product, necessitates robust customer service. This section details the support options available to cardholders, ensuring a smooth experience with the card’s features and benefits.

Maintaining a positive customer experience is paramount, especially when dealing with financial matters. This section will Artikel the various support channels, dispute resolution procedures, and highlight customer feedback to provide a comprehensive understanding of the card’s support system.

Customer Service Channels

Various contact methods are available for addressing queries and resolving issues related to the Delta SkyMiles Business Card. These methods offer different levels of immediacy and support.

- Online portal:

- A dedicated online portal provides access to frequently asked questions, account information, and tools for managing your account. This is often the first point of contact for simple inquiries.

- Phone support:

- Phone support offers direct interaction with customer service representatives. This is beneficial for more complex issues that require personalized assistance.

- Email support:

- Email support allows for detailed communication regarding specific issues, enabling cardholders to document their concerns and receive comprehensive responses.

- Chat support:

- Real-time chat support provides instant assistance for immediate issues and quick responses to basic queries.

Dispute Resolution Process

The Delta SkyMiles Business Card has a clear process for handling billing disputes. This process ensures that cardholders can address any discrepancies in a timely and effective manner.

- Documentation:

- Maintain detailed records of transactions and any discrepancies, including dates, amounts, and descriptions.

- Contacting Support:

- Contact the designated customer service channel, outlining the issue and providing supporting documentation.

- Escalation Procedure:

- If the initial resolution is unsatisfactory, follow the escalation procedures Artikeld by Delta, which may involve escalating the case to a supervisor or specialist.

Customer Support Testimonials (Examples)

- Positive Feedback:

- “I was very impressed with the quick response time I received via chat. My issue was resolved in less than 15 minutes.” – John Smith..

- “The online portal is very user-friendly, and I found all the information I needed regarding my account. I’ve been a loyal customer for 10 years now.” – Sarah Jones

- Areas for Improvement:

- “While the online portal is helpful, the search function could be more effective.” – David Lee

Customer Service Support Table

| Issue Type | Contact Method | Resolution Steps |

|---|---|---|

| Billing error | Phone support or online portal | Provide transaction details, explain the error, and follow the escalation procedure if necessary. |

| Account access issues | Online portal or phone support | Verify account information and request assistance from the support team to reset password/access issues. |

| Reward redemption problem | Online portal or phone support | Provide details of the redemption attempt and relevant account information to the support team. |

Travel Experiences and Use Cases

Source: bestcards.com

Maximizing the value of your Delta SkyMiles Business Card hinges on understanding how it aligns with your specific travel needs. This section details various scenarios where the card shines, particularly for business travelers, highlighting its advantages and potential over other options.

This card isn’t a one-size-fits-all solution; its strengths lie in its adaptability to diverse travel situations. By considering the specific benefits and features, you can determine if it’s the ideal choice for your professional journey.

Business Trip Use Cases

The card excels for frequent business travelers. Its enhanced earning potential on flights and hotels, combined with valuable perks, provides a significant return on investment.

- Frequent Flyers: The card’s elevated earning rate on Delta flights makes it an attractive option for individuals traveling frequently travel on Delta. This translates to substantial rewards accumulation, especially for those already on a frequent-flying schedule. For example, a sales representative traveling weekly to different regional offices will accumulate significant miles quickly, potentially achieving free flights or upgrades.

- Hotel Stays: The bonus points for hotel stays are another critical advantage. Using the card for hotel bookings during business trips allows you to earn substantial points, potentially offsetting a significant portion of your accommodation costs.

- Extensive Business Trips: For extended business trips spanning multiple locations or requiring multiple flights, the card’s rewards become even more valuable. Accumulating miles and points for multiple flights, hotels, and potentially rental cars can result in significant savings on future travel.

Choosing the SkyMiles Business Card over Alternatives

In some cases, the SkyMiles Business Card might outperform other business travel cards. This often depends on your spending habits and travel patterns.

- Delta Frequent Flyer: If you primarily travel on Delta, the SkyMiles Business Card offers a superior return compared to general travel cards. The card’s tailored benefits directly complement your frequent Delta travel, making it a more cost-effective choice.

- High-Spending Travelers: For business travelers with substantial spending on flights, hotels, and other eligible expenses, the card’s bonus points can be particularly lucrative. The substantial rewards earned can quickly offset travel expenses.

- Business Travelers with Delta-Focused Needs: Individuals who frequently travel with Delta, book hotels with Delta partners, or utilize other Delta-branded services will experience the most significant advantages with this card.

Specific Travel Need Advantages

This card’s flexibility extends to various travel needs. Its tailored rewards can offer significant benefits.

- Booking Flights and Hotels: Earning points on flights and hotel stays directly impacts the value of the card, especially for those who prioritize booking flights and hotels through Delta partners.

- Global Travel: While the card is primarily focused on Delta flights, it can be used for global travel when combined with Delta’s extensive global network. This could include connecting flights, offering additional benefits to those traveling internationally.

Case Studies: Successful Use Cases, Delta Skymiles Business Card

Illustrative examples of successful use cases showcase the card’s practical application and value.

- John Smith, Regional Sales Manager: John frequently travels to various regional offices on Delta flights, using the card for all travel expenses. He consistently receives free flights and hotel stays, significantly reducing his travel costs.

- Sarah Chen, Marketing Director: Sarah uses the card for all her business trips, booking flights and hotels through Delta partners. She has accumulated enough points to cover several future trips, effectively transforming her travel budget.

Practical Tips and Strategies

Source: fastly.net

Leveraging your Delta SkyMiles Business Card effectively requires a strategic approach. This section details practical tips and strategies for maximizing its value, from earning rewards quickly to optimizing your travel experiences. Understanding these techniques can significantly enhance your overall return on investment.

Maximizing Rewards Value

Careful planning and execution are crucial for getting the most out of your Delta SkyMiles Business Card. Strategic booking and spending habits can dramatically increase your rewards earnings.

- Prioritize Delta Flights: Utilize your card for all Delta flights, both domestic and international. This directly capitalizes on the card’s primary benefit, maximizing your SkyMiles accumulation.

- Strategic Spending: Identify spending categories where you can strategically use your card to earn bonus miles, such as dining, entertainment, or retail purchases.

- Pairing with Delta Co-branded Credit Cards: If you have other Delta co-branded credit cards, utilize them in conjunction with your Business Card to further boost your mileage accrual. This often involves linking accounts and understanding the specific benefits of each card.

- Utilize Delta’s Partner Programs: Explore Delta’s extensive network of partner airlines and hotels to earn additional miles. This often involves combining travel with partner accommodations and transportation options.

Earning Rewards Quickly and Efficiently

Efficient strategies for maximizing your rewards accumulation are key to quick and substantial benefits. A well-defined approach allows for faster attainment of desired travel milestones.

- Understanding the Earn Rate: Thoroughly research the earning rate for various spending categories. Knowing where you can earn the most miles per dollar is essential for efficient reward accumulation.

- Utilizing Bonus Offers: Keep an eye out for promotional periods and bonus offers that might increase the earning potential of your card. These often coincide with special events or travel seasons.

- Creating a Budget: Allocate a portion of your spending to maximize the earning potential of the Delta SkyMiles Business Card. This budget prioritizes purchases on the card, ensuring consistent rewards accrual.

Choosing the Right Travel Companions

Accompanying companions on trips can significantly impact your reward accrual and travel experiences. Careful consideration of the needs of fellow travelers is key to optimized travel planning.

- Travel Companions and Benefits: Evaluate the travel companions’ status and how their potential usage of the same card will affect your rewards.

- Shared Travel Plans: Align travel plans with your travel companions to maximize the benefits of the Delta SkyMiles Business Card. This may involve coordinating travel dates and booking arrangements.

- Understanding Their Travel Needs: Consider their specific needs and travel preferences to tailor the travel experience to all participants. This ensures a mutually beneficial and enjoyable travel journey.

Tracking Travel Spending and Rewards Progress

Regular tracking of travel spending and reward progress provides valuable insights for future planning. This proactive approach is critical for understanding and optimizing your reward earnings.

- Regularly Monitoring Statements: Review your credit card statements to track spending and ensure accurate reward calculations. This meticulous approach minimizes any errors or misunderstandings related to reward accumulation.

- Utilizing Delta’s Online Portal: Utilize Delta’s online portal to monitor your account balance and the status of your accumulated miles. This facilitates a detailed understanding of your progress towards desired travel goals.

- Creating a Log: Maintain a log or spreadsheet to track your spending, mileage accrual, and upcoming travel plans. This organized approach helps in planning future trips and optimizing reward redemption.

Pro-Tips for Optimizing Rewards and Travel Experiences

Following these practical tips will help you effectively manage your rewards and optimize your travel experiences. These pro tips will help you make the most of your Delta SkyMiles Business Card.

- Enroll in Delta’s Email List: Sign up for Delta’s email list to stay informed about exclusive offers, promotions, and special programs. This proactive measure will keep you updated on new opportunities to maximize your rewards.

- Utilize Delta’s Mobile App: Take advantage of the Delta mobile app to manage your account, track your rewards, and book flights. This simplifies the entire process, from reward tracking to booking.

- Consider Delta SkyMiles Medallion Status: Understanding the requirements for Delta SkyMiles Medallion Status can help you achieve higher tiers and exclusive benefits. This approach can significantly enhance your overall travel experience.

Closure

Source: financebuzz.com

In conclusion, the Delta SkyMiles Business Card presents a compelling option for business travelers seeking a robust rewards program and travel benefits. Careful consideration of the eligibility criteria, reward structures, and potential drawbacks, along with comparisons to other cards, will help determine its suitability. The provided resources and practical tips should enable readers to make informed choices when evaluating this card for their individual needs and business travel habits.