Business Delta A Comprehensive Guide

Business delta, a key concept in understanding and managing business performance, encompasses various aspects from finance to operations and strategy. This guide dives deep into defining, calculating, and analyzing business delta, offering insights into its impact, trends, and strategic implementation.

We’ll explore the different interpretations of business delta across various business functions, like cost delta, revenue delta, and market share delta. Detailed calculations, illustrated by examples using financial and operational data, will be presented. Furthermore, we’ll examine the influence of positive and negative business deltas on business decisions and functions.

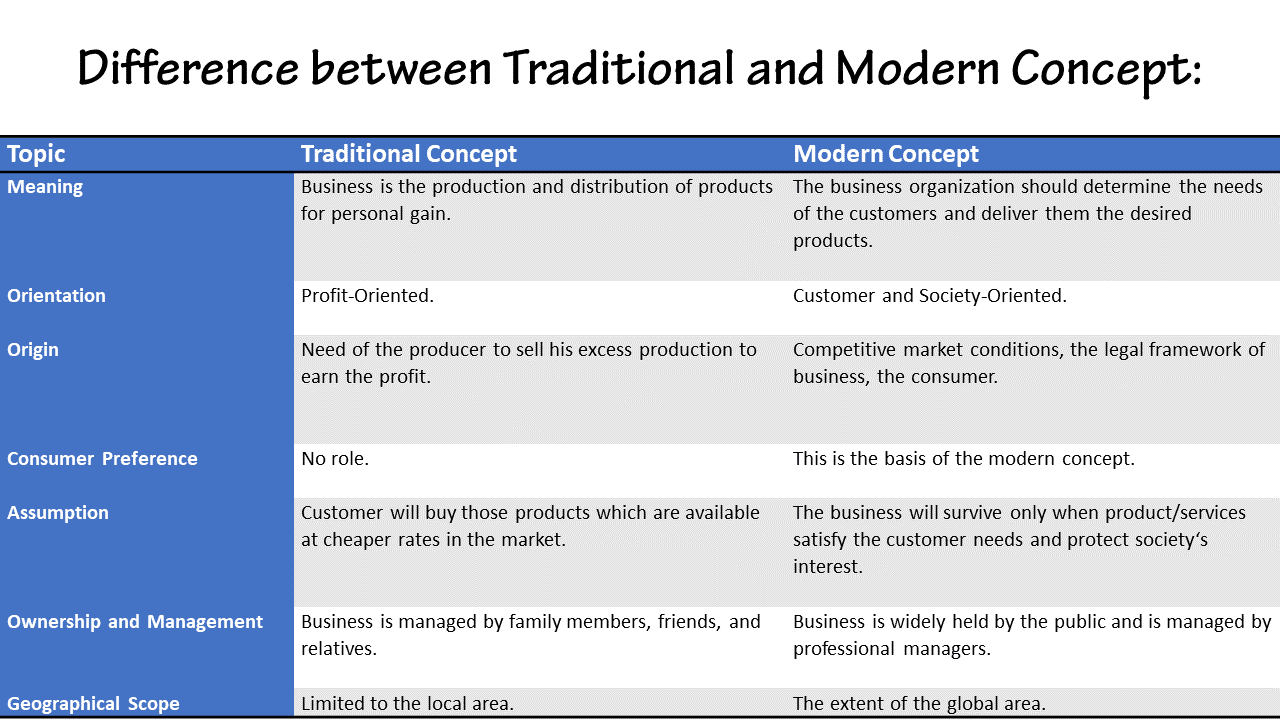

Defining Business Delta

Source: ilearnlot.com

The term “business delta” refers to the measurable difference in a business’s performance or position over a specific period. It captures the change in key metrics, reflecting the impact of various strategies, initiatives, or market fluctuations. This difference can be positive or negative, signifying improvement or decline. Understanding the business delta is crucial for evaluating the effectiveness of business decisions and identifying areas for optimization.

A business delta encompasses a broad spectrum of interpretations, ranging from financial performance adjustments to operational efficiency improvements and strategic shifts. In the realm of finance, it might represent the difference in profits between two periods; in operations, it could signify a change in production output or resource utilization; and in strategy, it might indicate the shift in market share or customer acquisition rates. Each context provides a unique lens for interpreting the delta, offering insights into different aspects of business performance.

Different Interpretations of Business Delta

Business deltas are multifaceted and adaptable to various contexts. In finance, the delta might represent a change in net income, revenue, or profit margins. In operations, it could measure changes in production time, efficiency, or resource utilization. From a strategic standpoint, a business delta can track changes in market share, customer acquisition rates, or brand recognition.

Key Components of a Business Delta

Several factors contribute to the calculation and interpretation of a business delta. These key components include:

- Baseline Data: The initial or starting point for comparison. This is essential for establishing a reference point against which subsequent changes can be measured. Without a baseline, it is impossible to determine whether a change represents improvement or decline.

- Comparative Data: The subsequent data point or period used for comparison with the baseline. This enables calculation of the difference, revealing the shift in performance or position. The comparison period should be chosen carefully to ensure comparability and relevance to the analysis.

- Metrics: The specific measurements used to determine the delta. Common metrics include revenue, cost, profit, market share, customer satisfaction scores, and operational efficiency rates.

- Contextual Factors: Understanding the surrounding circumstances that might influence the delta is vital. External factors such as economic conditions, industry trends, or competitor activities can significantly impact business performance and should be considered.

Types of Business Deltas

Different types of business deltas focus on specific aspects of performance. A comprehensive analysis often considers multiple deltas to gain a holistic view.

| Type of Delta | Description | Example |

|---|---|---|

| Cost Delta | Represents the change in total costs over a period. | A company’s manufacturing costs decrease by $10,000 from Q1 to Q2. |

| Revenue Delta | Measures the change in total revenue generated. | Sales revenue increases by 15% year-over-year. |

| Market Share Delta | Indicates the change in market share held by a business. | A company’s market share grew from 12% to 15% in the last quarter. |

| Profit Delta | Represents the change in profit or net income. | The company’s profit margin improved by 2 percentage points. |

Calculating Business Delta

Calculating business delta involves quantifying the difference between a company’s current performance and its desired or projected performance. This difference can be assessed across various dimensions, from financial metrics to operational efficiency. Understanding how to calculate business delta accurately is crucial for identifying areas needing improvement and developing strategies for achieving desired outcomes. The accurate calculation of business delta relies on a clear definition of the target or baseline. This target might be historical performance, industry benchmarks, or a projected future state. A precise understanding of the baseline is critical for effective comparison and the identification of areas for improvement.

Methods for Calculating Business Delta in Different Scenarios

Various methods exist for calculating business delta, depending on the specific area of focus and the available data. These methods vary from simple subtractions to more complex calculations involving statistical analysis. Careful consideration of the specific context is vital for selecting the appropriate approach.

- In financial contexts, business delta often involves comparing actual revenue, expenses, or profit margins against projected or target figures. This comparison highlights areas where performance deviates from expectations.

- Operational contexts might involve evaluating metrics like production output, customer satisfaction, or employee efficiency. The delta here is the difference between actual performance and the desired or expected level.

Importance of Accurate Data in Calculating Business Delta

Accurate data is paramount for a reliable business delta calculation. Inaccurate data can lead to misleading conclusions and ineffective strategies. Rigorous data collection and validation procedures are essential to ensure the accuracy of calculations.

Examples of Calculating Business Delta Using Financial Data

Consider a company aiming to increase its profit margin. The company’s actual profit margin in the previous quarter was 10%. Their projected profit margin was 15%. The business delta in this case is 5 percentage points.

Business Delta = Projected Profit Margin – Actual Profit Margin

Another example is a company aiming to reduce operational costs. The actual operational costs for the previous quarter were $100,000, while the projected cost was $80,000. The business delta in this instance is $20,000.

Business Delta = Projected Operational Cost – Actual Operational Cost

Detailing the Steps Involved in Calculating Business Delta in Operational Contexts

Calculating business delta in operational contexts often involves multiple steps. First, define the key performance indicators (KPIs) to measure. Next, gather the necessary data, ensuring accuracy and consistency. Establish a baseline or target value for each KPI. Finally, calculate the difference between the actual and target values for each KPI.

- Defining the key operational metrics that need analysis. Examples include production output, customer satisfaction ratings, and employee turnover rates.

- Collecting the required data from various sources, including internal databases and customer surveys.

- Establishing a baseline or target for each metric. This baseline could be historical data, industry averages, or company goals.

- Calculating the difference between the actual values and the target values for each metric. This difference is the business delta.

Impact of Business Delta

The business delta, a crucial metric for assessing business performance, reflects the difference between projected and actual results. Understanding its impact, both positive and negative, is vital for informed decision-making and strategic adjustments. A deep dive into the effects of this difference allows businesses to fine-tune their operations and achieve optimal outcomes.

Potential Impact of a Positive Business Delta

A positive business delta signifies that actual results surpassed projections. This favorable outcome often leads to increased profitability, improved market share, and enhanced brand reputation. The positive impact ripples through various facets of the business, leading to greater investor confidence and potential for future growth. For example, a positive delta in sales might translate into higher dividends for shareholders or reinvestment in expansion.

Potential Impact of a Negative Business Delta

Conversely, a negative business delta indicates that actual results fell short of projections. This shortfall can manifest in decreased profitability, declining market share, and a tarnished brand image. Addressing the underlying causes of the negative delta is critical for restoring profitability and maintaining market competitiveness. For instance, a negative delta in customer acquisition could indicate a need for improved marketing strategies or a reassessment of the product offering.

Factors Influencing Business Delta

Several factors can influence the size and direction of a business delta. These include market fluctuations, changes in consumer preferences, economic conditions, competitive pressures, and internal operational inefficiencies. Furthermore, unforeseen events, such as natural disasters or pandemics, can significantly impact the delta. A thorough understanding of these influencing factors is crucial for mitigating risks and capitalizing on opportunities.

Examples of Business Delta Impacting Business Decisions

Business delta plays a pivotal role in shaping crucial business decisions. For example, a positive delta in customer satisfaction might lead to increased marketing investments in similar strategies. Conversely, a negative delta in production costs might necessitate changes in the supply chain or manufacturing processes. The ability to analyze the delta empowers businesses to react proactively to changing market conditions and maintain a competitive edge.

Impact of Business Delta on Business Functions

The impact of a business delta extends across various business functions. A well-defined analysis of the delta allows businesses to tailor strategies to specific functions.

| Business Function | Positive Delta Impact | Negative Delta Impact |

|---|---|---|

| Sales | Increased revenue, higher market share, improved sales forecasting models | Decreased revenue, loss of market share, adjustments to sales strategies |

| Marketing | Enhanced brand perception, increased customer engagement, effective marketing campaigns | Reduced customer engagement, decreased brand awareness, need for re-evaluation of marketing strategies.. |

| Operations | Improved efficiency, cost reduction, and enhanced productivity | Increased costs, lower productivity, re-evaluation of operational procedures |

| Finance | Increased profitability, higher returns on investment, better financial planning | Reduced profitability, lower returns on investment, and revised financial forecasts |

Analyzing Business Delta Trends

Understanding historical business delta trends and forecasting future ones is crucial for strategic planning. Accurate analysis allows businesses to adapt to changing market conditions, capitalize on emerging opportunities, and mitigate potential risks. This section details the methods for analyzing historical data, forecasting future trends, and integrating this understanding into strategic decision-making.

Analyzing Historical Business Delta Trends

A thorough analysis of historical business delta trends requires a systematic approach. This involves collecting and organizing relevant data, identifying patterns, and evaluating the factors influencing these patterns. Key considerations include the time frame (e.g., quarterly, annually), the specific metrics used to calculate the delta (e.g., revenue, profit margin, customer acquisition cost), and the context within which the data was collected.

Methods for Forecasting Future Business Delta Trends

Forecasting future business delta trends involves leveraging historical data, market analysis, and expert judgment. Several methods can be employed, such as regression analysis, time series analysis, and scenario planning. These methods aim to identify trends, extrapolate patterns, and estimate potential future outcomes based on the observed data.

Significance of Understanding Business Delta Trends for Strategic Planning

Understanding business delta trends is vital for effective strategic planning. It enables businesses to anticipate market shifts, adjust their strategies proactively, and allocate resources optimally. By anticipating future challenges and opportunities, businesses can make informed decisions regarding product development, marketing campaigns, and resource allocation.

Illustrative Historical Data of Business Delta Trends (Retail Industry)

This table presents a simplified representation of historical business delta trends in the retail industry. It illustrates how revenue delta (percentage change in revenue) can vary across different periods. Note that this is a hypothetical example, and actual data would vary based on specific retail sectors and company performance.

| Year | Revenue Delta (%) | Economic Conditions |

|---|---|---|

| 2020 | -15% | Pandemic-related lockdowns and economic downturn |

| 2021 | +20% | Economic recovery and increased consumer spending |

| 2022 | +5% | Inflationary pressures and supply chain disruptions |

| 2023 | +10% | Continuing inflationary pressures, evolving consumer preferences |

Using Business Delta Trends to Predict Future Market Conditions

Business delta trends can be instrumental in predicting future market conditions. For instance, a consistent positive trend in customer acquisition cost delta (CAC delta) could suggest a competitive market, potentially prompting businesses to consider adjusting their marketing strategies. Conversely, a sustained negative trend in revenue delta might indicate a need for product innovation or a strategic shift in market focus. The analysis should encompass various factors like economic indicators, competitor actions, and evolving consumer preferences.

Understanding the context behind the delta is crucial for accurate prediction.

Implementing Strategies Based on Business Delta

Successfully navigating the complexities of the business landscape requires a proactive approach to analyzing and responding to fluctuations in performance. Understanding the Business Delta, a critical measure of change, empowers businesses to adapt strategies effectively. This section delves into strategies for capitalizing on positive deltas and mitigating the negative impact of a negative delta.

Capitalizing on a Positive Business Delta

A positive Business Delta signifies growth and improvement in key performance indicators (KPIs). Strategies for leveraging this positive momentum are crucial for maximizing returns and future success.

- Investment in Expansion: A positive delta often signals increased profitability and cash flow. This allows for strategic investment in expanding operations, potentially through new product lines, geographic market penetration, or the acquisition of complementary businesses. For example, a tech company experiencing a positive delta in user growth might invest in expanding its development team and infrastructure to accommodate the increased demand.

- Employee Retention and Growth: A healthy Business Delta often correlates with increased revenue and profitability, providing the resources for enhanced employee compensation and benefits. This fosters a positive work environment, boosts employee morale, and encourages retention. Furthermore, this creates opportunities for employee training and development, strengthening the workforce and improving overall performance.

- Market Share Enhancement: A positive Business Delta indicates a strong market position. Strategies to capitalize on this include aggressive marketing campaigns targeting new customer segments, improving existing product offerings to better address market needs, or expanding into new, related markets. An example is a retail company experiencing a positive delta in sales, which could invest in advanced marketing strategies to increase market share and customer loyalty.

Mitigating the Impact of a Negative Business Delta

A negative Business Delta indicates a decline in performance. Proactive mitigation strategies are crucial to prevent further deterioration and restore profitability.

- Cost Reduction Initiatives: Identifying and implementing cost-cutting measures can mitigate the impact of a negative Business Delta. This could involve renegotiating contracts with suppliers, streamlining operational processes, or reducing overhead expenses. For instance, a manufacturing company experiencing declining sales could implement lean manufacturing principles to optimize production and reduce waste.

- Targeted Marketing Strategies: A negative delta might signal a need to re-evaluate marketing strategies. Refocusing on specific customer segments, adjusting marketing campaigns, and introducing new value propositions are crucial. An online retailer experiencing a negative delta in website traffic might implement a targeted marketing campaign focusing on specific demographics and interests to attract new customers.

- Process Optimization: Analyzing and streamlining business processes is crucial for improving efficiency and minimizing losses. Identifying bottlenecks, implementing automation solutions, or re-engineering processes can help restore productivity and profitability. A call center facing a negative delta in customer satisfaction could optimize call routing procedures and improve staff training to address customer issues efficiently.

Adapting Strategies Based on Business Delta Trends

Understanding the trajectory of the Business Delta is crucial for successful strategy implementation. Consistent monitoring and adaptation to emerging trends are essential.

- Trend Analysis: Regularly analyzing the Business Delta trends, such as identifying seasonal patterns or cyclical fluctuations, is critical. This understanding guides the adaptation of strategies to align with the evolving market dynamics. A company facing fluctuating sales throughout the year can adjust production, inventory, and marketing efforts accordingly.

- Dynamic Resource Allocation: Resource allocation strategies should adapt based on Business Delta trends. Resources should be redirected to areas showing growth potential and reduced in areas experiencing decline. This agility ensures that the company remains aligned with its most promising opportunities.

- Continuous Improvement: The Business Delta serves as a constant feedback mechanism. Continuous monitoring of the delta’s evolution allows for iterative adjustments to strategies, ensuring alignment with the current market realities. For example, a software company monitoring a decreasing number of users in a specific region might adjust its marketing strategy for that region, potentially through localization efforts.

Strategies Implementation Table

| Business Delta | Strategy Focus | Implementation Details |

|---|---|---|

| Positive | Growth and Expansion | Invest in new product lines, expand into new markets, and enhance employee training. |

| Negative | Cost Reduction and Optimization | Streamline processes, renegotiate contracts, reduce overhead costs, re-evaluate marketing campaigns. |

| Increasing | Reinforce Success | Continue successful strategies, adjust based on the rate of growth, and invest strategically. |

| Decreasing | Crisis Management | Identify causes, implement short-term cost-cutting measures, prioritize vital operations, and explore strategic partnerships. |

Monitoring Strategy Effectiveness

Implementing strategies based on the Business Delta is only effective when measured and adjusted as needed. Key metrics for monitoring strategy effectiveness include:

- Key Performance Indicators (KPIs): Regular tracking of KPIs, such as revenue, profitability, customer satisfaction, and market share, is critical for assessing the impact of implemented strategies.

- Feedback Mechanisms: Implementing feedback loops from employees, customers, and stakeholders provides valuable insights into the effectiveness of implemented strategies.

- Regular Reporting: Consistently reporting on the progress of strategies against established goals enables proactive adjustments and course corrections.

Illustrative Examples of Business Delta

Business delta, a crucial metric for evaluating a business’s performance, represents the difference between projected and actual outcomes. Understanding positive and negative deltas, along with the factors impacting them, is essential for strategic decision-making. These examples illustrate how businesses can leverage this analysis for growth and adaptation.

Analyzing historical data and comparing them to projections allows companies to pinpoint areas of success and identify areas needing improvement. This insightful comparison is invaluable for adapting strategies and enhancing future performance.

Positive Business Delta Example: E-commerce Growth

A burgeoning online retailer, “TechGear,” initially projected a 15% increase in sales for the fiscal year. However, due to successful marketing campaigns and strategic partnerships, they achieved a 25% growth. This positive delta of 10% signifies exceeding expectations and demonstrates effective business strategies. This success likely resulted from a combination of factors, such as optimized online advertising, improved customer service, and strategic partnerships.

Negative Business Delta Example: Manufacturing Downtime

A manufacturing company, “PrecisionParts,” anticipated a 5% increase in production output. Unexpected maintenance issues and supply chain disruptions resulted in a 2% decrease in output, creating a negative delta of 7%. This example highlights the vulnerability of businesses to unforeseen external factors. The resulting decrease in output significantly impacted profitability and production targets.

Case Study: Software Company Utilizing Business Delta Analysis

“InnovateSoft,” a software development company, consistently monitored their business delta. They recognized a negative delta in their project completion times. Analysis revealed that inadequate project planning and insufficient resource allocation were the root causes. By implementing project management software and improving team communication, they effectively addressed the issues. This led to a significant improvement in project completion times, resulting in a positive delta. This example demonstrates the value of proactive analysis and strategic adjustments.

Comparison of Two Similar Companies

| Metric | Company A | Company B |

|---|---|---|

| Projected Revenue Growth | 10% | 12% |

| Actual Revenue Growth | 15% | 8% |

| Business Delta | +5% | -4% |

| Key Factors for Delta Difference | Stronger-than-expected marketing campaign and expansion into new markets | Production issues and delays in the supply chain |

This table highlights the stark contrast in performance between two similar companies. Company A’s positive delta underscores the potential for exceeding projections through effective strategies. Conversely, Company B’s negative delta emphasizes the need for proactive measures to address external factors that may hinder progress.

Impact of External Factors on Business Delta

External factors significantly impact a business’s delta. Economic downturns can lead to negative deltas, as seen in decreased consumer spending. Conversely, favorable economic conditions can result in positive deltas, such as increased demand for products. Technological advancements can also shift a company’s delta. For instance, a company embracing new technologies might experience a significant positive delta. Natural disasters, geopolitical events, and even pandemics can lead to negative business deltas, impacting supply chains, demand, and operational efficiency. Understanding these influences allows businesses to adapt their strategies and mitigate risks.

Visual Representation of Business Delta

Visual representation of business delta is crucial for understanding its evolution and impact. Effective visualizations transform complex data into easily digestible insights, allowing stakeholders to grasp trends and make informed decisions quickly. Different types of visualizations are tailored to highlight specific aspects of business delta, from historical changes to the effects of strategic interventions.

Time-Series Representation of Business Delta

Understanding how business delta fluctuates over time is essential. A line graph is a suitable choice for this. The horizontal axis represents time, while the vertical axis shows the business delta value. A rising line indicates a positive delta, a falling line indicates a negative delta, and a flat line indicates stability. Adding trend lines can highlight long-term patterns. For instance, a consistently upward trend could suggest a growing market share, while a downward trend could signify market saturation or increased competition.

Impact of Strategies on Business Delta

Visualizing the effect of different strategies on business delta can be achieved using bar charts or clustered column charts. Different strategies can be represented by different bars or columns, while the vertical axis reflects the corresponding delta values. For example, a comparison of the business delta achieved by implementing a new marketing campaign versus maintaining the existing strategy could be displayed using a clustered column chart. The difference in delta values between the strategies will be immediately apparent.

Correlation Between External Factors and Business Delta

Scatter plots effectively illustrate the correlation between external factors and business delta. One axis could represent an external factor, such as economic growth or consumer confidence, while the other axis displays the business delta. A positive correlation would show a tendency for business delta to increase as the external factor improves, while a negative correlation would indicate the opposite. A scatter plot allows for a visual assessment of the strength and direction of the relationship.

Using Charts and Graphs for Business Delta Illustration

Charts and graphs provide a clear and concise way to illustrate business delta concepts. Pie charts can effectively display the distribution of delta contributions from different departments or products. For example, the proportion of business delta generated by different product lines can be illustrated. Histograms can showcase the frequency distribution of business delta values, revealing insights into the typical delta range.

Comparative Analysis of Business Delta Across Industries

Comparing business delta across various industries can be accomplished using a combination of bar charts and comparative line graphs. For example, a bar chart could show the average business delta for each industry, while line graphs could illustrate the historical trends for specific industries. This allows for a comparative analysis of the performance of different sectors. Industries with consistently high business deltas might showcase innovative practices or market dominance.

| Industry | Average Business Delta (2022) | Trend (2022-2023) |

|---|---|---|

| Retail | +5% | Positive, steady increase |

| Technology | +12% | Positive, accelerated growth |

| Finance | +3% | Positive, moderate growth |

Concluding Remarks

In conclusion, understanding business delta is crucial for effective strategic planning and decision-making. Analyzing historical trends, forecasting future outcomes, and implementing tailored strategies based on calculated deltas are vital for maximizing growth opportunities and mitigating potential risks. The guide’s comprehensive examples, including positive and negative delta scenarios, and visual representations, provide a practical framework for businesses to effectively utilize this powerful tool.