Corporate Travel & Expense Management A Modern Guide

Corporate travel and expense management is crucial for modern businesses. Effective systems streamline processes, optimize budgets, and ensure compliance. This guide explores the intricacies of travel policies, reporting procedures, and technology solutions, providing insights into cost optimization and security measures. We’ll also discuss employee training and future trends in this dynamic field.

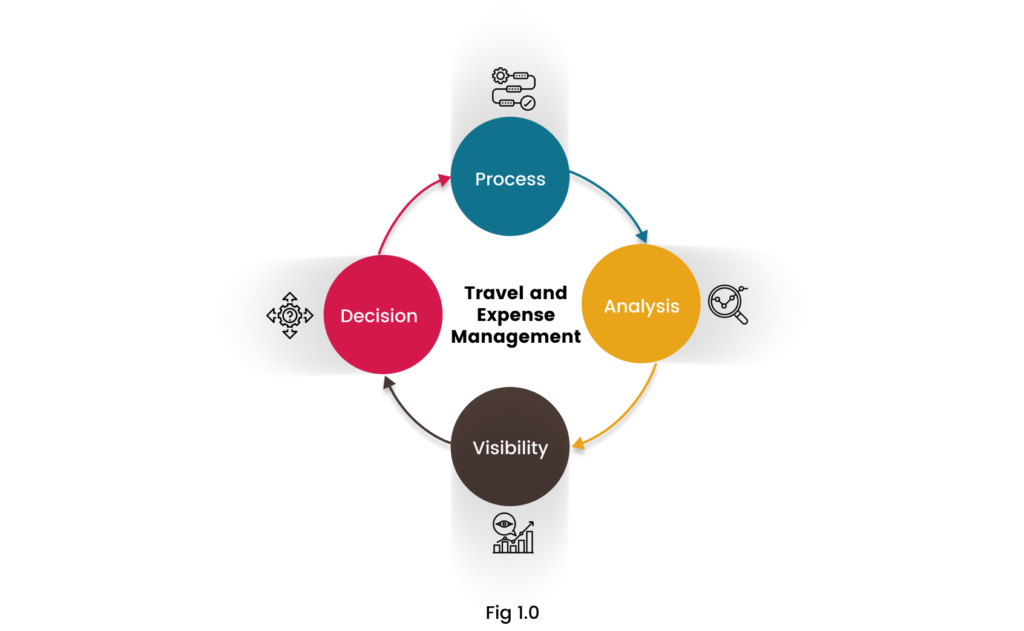

From establishing clear travel policies to implementing robust expense reporting, this comprehensive overview addresses the multifaceted nature of corporate travel and expense management. Understanding the key functionalities of a robust CTEM solution is essential for success in today’s business environment. A well-structured system promotes efficiency, reduces errors, and facilitates accurate financial reporting.

Introduction to Corporate Travel and Expense Management

Corporate Travel and Expense Management (CTEM) encompasses the processes and systems used by businesses to track, manage, and reimburse employee travel and expense claims. This includes a broad spectrum of activities, from booking flights and hotels to processing receipts and ensuring compliance with company policies and regulations. Effective CTEM is crucial for maintaining financial control, optimizing travel costs, and adhering to legal requirements.

Importance of Effective CTEM Systems

Modern businesses rely heavily on their employees’ ability to travel for various reasons, including attending conferences, meeting clients, and conducting business in different locations. An effective CTEM system is vital for streamlining these processes and ensuring transparency and accountability. This contributes significantly to cost savings, accurate financial reporting, and improved employee experience.

Key Functionalities of a Robust CTEM Solution

A robust CTEM solution offers a suite of functionalities designed to optimize the entire travel and expense cycle. These include:

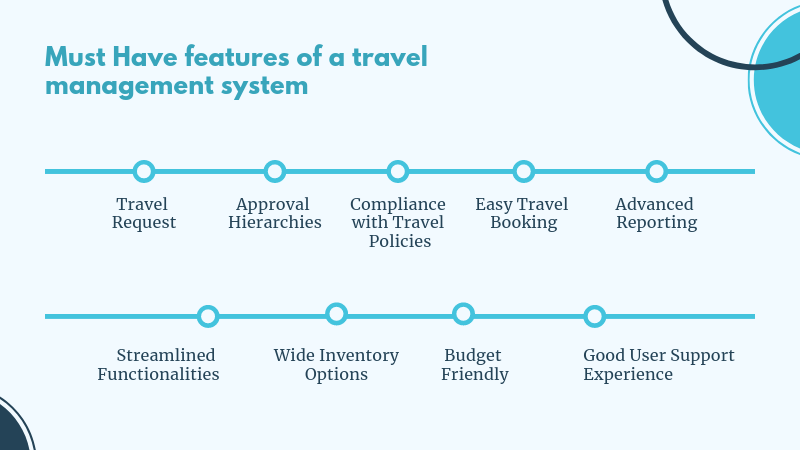

- Travel Booking and Management: Integrating with various travel agencies and suppliers allows for the booking of flights, hotels, and other travel arrangements directly within the system. This functionality often includes tools for comparing prices, selecting preferred vendors, and managing itineraries.

- Expense Reporting and Submission: Employees can easily submit expense reports, including receipts, mileage logs, and other relevant documentation. The system validates these claims against company policies and regulations, reducing errors and increasing efficiency.

- Automated Approval and Reimbursement: Streamlined workflows automate the approval process for expense reports, accelerating the reimbursement cycle and minimizing delays. This typically involves predefined approval hierarchies and automated matching of receipts to expenses.

- Reporting and Analytics: Comprehensive reports provide insights into travel costs, spending trends, and compliance adherence. These reports allow for informed decision-making and potential cost optimization strategies. They often include detailed breakdowns of expenses by location, department, or employee.

- Compliance and Policy Management: A critical component of CTEM systems is the ability to enforce company travel and expense policies. This feature ensures adherence to regulations, minimizes risks, and improves financial accountability.

Typical CTEM Process Flow

The following diagram illustrates a simplified process flow of a typical CTEM system.

| Step | Description |

|---|---|

| 1. Travel Request | Employee initiates a travel request, specifying destination, dates, and purpose. |

| 2. Booking and Confirmation | The system facilitates the booking of flights, hotels, and other travel arrangements. Confirmation of bookings is recorded within the system. |

| 3. Expense Tracking | Employees record their expenses during travel, including receipts, mileage, and other relevant documentation. |

| 4. Expense Report Submission | Employees submit their expense reports through the system. |

| 5. Approval and Review | Approvers review and approve or reject the expense report. |

| 6. Reimbursement | Upon approval, the system processes the reimbursement to the employee. |

Travel Policy and Expense Reporting

Travel policies and expense reporting systems are crucial for managing corporate travel costs effectively. A well-defined policy ensures compliance with company regulations, promotes transparency, and streamlines the reimbursement process. This section details the different types of travel policies, expense reporting processes, and example expense categories.

Comprehensive expense reporting is essential for accurate financial record-keeping and tracking of business-related travel expenditures. Effective expense reporting allows for better budget control, compliance with accounting standards, and facilitates auditing procedures. A structured process simplifies the reimbursement process, reduces potential errors, and minimizes the administrative burden on both employees and the finance department.

Types of Travel Policies

Companies implement various travel policies based on their specific needs and industry standards. These policies often encompass elements like pre-approval requirements, allowed travel methods, preferred lodging options, and meal allowances. Specific policies might address business class versus economy class travel, permissible lodging levels, and reimbursement rates for specific types of transportation. Examples include policies restricting travel to certain regions or prescribing a particular level of lodging for various trip types.

Key Components of a Comprehensive Expense Reporting Process

A robust expense reporting process involves several key components to ensure accuracy, efficiency, and compliance. These components include clear guidelines for expense categorization, detailed documentation requirements, and a secure online platform for submitting and processing reports. The process also needs to include a well-defined timeline for expense report submission, a clear explanation of the reimbursement procedure, and a designated team for reviewing and approving reports.

Expense Categories

Different types of expenses are incurred during business travel. These can be categorized for tracking and reporting purposes. Common expense categories include lodging, transportation, meals, and incidentals.

- Lodging: This includes hotel or accommodation costs. Examples include room rates, taxes, and fees.

- Transportation: This encompasses costs associated with getting to and from destinations. Examples include airfare, train tickets, and car rentals.

- Meals: This category covers expenses related to food and beverages. Examples include restaurant bills and company-provided meals.

- Incidentals: This encompasses miscellaneous expenses like parking fees, baggage fees, or local transportation.

Expense Report Fields

A well-structured expense report form contains various fields, each serving a specific purpose. These fields aid in organizing expenses and facilitating accurate reimbursement.

| Field | Description | Example | Importance |

|---|---|---|---|

| Date | Date of expense | 2024-10-27 | Chronological order of expenses |

| Description | Description of the expense | Business Meeting | Contextual information about expense |

| Amount | Value of the expense | $150 | Accurate financial tracking |

| Receipt | Supporting document for expense | Copy of invoice | Verification and compliance |

| Category | Expense type (e.g., lodging, transportation) | Lodging | Classification for reporting |

| Location | City/Country where expense was incurred | New York, USA | Geographic context for expense |

Technology and Tools in CTEM

Corp

orate Travel and Expense Management (CTEM) relies heavily on robust technology to streamline processes, enhance accuracy, and reduce administrative burdens. Effective CTEM solutions empower businesses to manage travel and expenses efficiently, ensuring compliance and cost control. Modern platforms offer a range of features, from automated expense reporting to sophisticated travel booking tools.

Various software solutions cater to different needs and budgets, enabling organizations to select tools tailored to their specific requirements. A well-chosen CTEM platform can significantly improve operational efficiency and provide valuable insights into travel spending patterns.

Software Solutions for CTEM

A wide array of software solutions cater to the diverse needs of businesses regarding CTEM. These solutions range from basic expense reporting tools to comprehensive platforms encompassing travel booking, expense tracking, and reporting. Each platform presents a unique combination of features and functionalities.

Comparison of CTEM Platforms

Different CTEM platforms offer varying functionalities, catering to specific business needs and budgets. Consideration of features like automated approvals, expense categorization, and reporting capabilities is crucial when selecting a platform.

Key Features of Modern CTEM Software

Modern CTEM software solutions incorporate key features designed to optimize processes and enhance user experience. Automated expense categorization and approvals are vital components of efficient expense management.

- Automated Approvals: Streamlines the expense approval process, reducing delays and improving operational efficiency. This feature often integrates with existing company workflows and security protocols.

- Automated Expense Categorization: Automatically categorizes expenses based on predefined rules, simplifying reporting and analysis. This feature ensures accurate expense tracking and reporting.

- Integration with Booking Tools: Seamlessly integrates with existing travel booking platforms, providing a unified view of travel arrangements and expenses. This integration facilitates streamlined reporting and better cost control.

- Real-time Reporting and Analytics: Provides real-time insights into travel spending patterns, allowing for proactive cost management and identification of potential savings.

Cost, Ease of Use, and Features Comparison

The table below compares three popular CTEM solutions based on cost, ease of use, and key features. This comparison provides a practical framework for businesses to assess available options.

| Solution | Cost | Ease of Use | Key Features |

|---|---|---|---|

| Solution A | High | Medium | Advanced Reporting, Automated Approvals, Comprehensive Travel Booking Integration |

| Solution B | Medium | High | Intuitive Interface, Basic Reporting, Expense Categorization |

| Solution C | Low | Low | Basic Expense Tracking, Limited Reporting |

Cost Optimization and Control

<p>Effective corporate travel and expense management (CTEM) is crucial for optimizing budgets and controlling costs. A well-structured CTEM program not only streamlines expense reporting but also facilitates the identification of areas for potential cost savings. This allows businesses to allocate resources more effectively and enhance overall profitability.

Optimizing travel budgets and controlling expenses are not just about reducing costs; they are about maximizing value for the money spent. This requires a proactive approach, encompassing careful planning, strategic decision-making, and consistent monitoring. By embracing a comprehensive CTEM strategy, companies can achieve substantial savings without compromising the quality of business travel experiences.

Methods for Optimizing Travel Budgets

Travel budget optimization requires a multi-faceted approach. Careful analysis of historical travel data, coupled with a clear understanding of current business needs, provides a solid foundation for developing realistic and achievable budgets. This data-driven approach allows for informed decisions regarding travel frequency, destination choices, and transportation methods.

- Analyzing historical travel data is paramount to identifying trends and patterns. This includes examining the costs associated with previous trips, including flights, accommodations, and ground transportation. Careful analysis of these patterns reveals opportunities for cost reduction, such as choosing more economical travel dates or utilizing alternative transportation options.

- Defining clear travel policies that align with business objectives is essential. These policies should detail acceptable travel expenses, including accommodation standards, meal allowances, and transportation preferences. Clearly defined policies ensure transparency and promote adherence to the budget.

- Implementing a robust system for tracking and monitoring travel expenses is critical. Utilizing expense reporting software allows for real-time tracking and analysis of spending patterns, enabling proactive identification of potential cost overruns.

Strategies for Controlling Travel and Expense Costs

Controlling travel and expense costs involves implementing various strategies that span the entire travel process. These strategies aim to balance cost-effectiveness with the quality of travel experiences for employees.

- Negotiating favorable rates with travel providers is a crucial cost-control strategy. This includes securing discounts on flights, hotels, and rental cars. Negotiating bulk contracts can often yield substantial savings, particularly for frequent travelers.

- Encouraging the use of cost-effective transportation options is essential. This may involve encouraging employees to utilize public transportation, ride-sharing services, or other alternatives to traditional taxis or rental cars, where appropriate. Evaluating the pros and cons of each option is critical to selecting the most cost-effective solution for each trip.

- Implementing travel booking tools and platforms that enable efficient management and control of travel expenses is vital. These tools often provide real-time cost comparisons, allowing for informed decisions based on pricing and availability. These systems also streamline the entire travel process.

Tools and Techniques for Cost Reduction in Corporate Travel

Several tools and techniques can be employed to further optimize travel expenses. A well-defined approach, combining technology with strategic decision-making, is essential for achieving significant cost reductions.

- yle=”list-style-type: none;”>

-

- <

;l</ul

- >

-

i>Utilizing corporate trave

-

- <

li styl

- e=”list-style-type: none;”>

-

- l management software can streamline

the e

-

- ntire travel process, from booking flights and accomm

odation

- s to expense reporting. Such software often offers real-time cost comparisons, enabling the selection of the most economical options. Furthermore, these systems often provide detailed expense reports and analytics, allowing for a thorough understanding of travel expenditure.

- Implementing dynamic pricing strategies, which adjust travel arrangements in response to fluctuating prices, is another key technique. Utilizing this strategy can result in considerable savings. For instance, booking flights or hotels during off-peak seasons can yield significant cost reductions.

- Promoting flexible work arrangements, such as remote work or virtual meetings, is a powerful strategy for reducing travel expenses. This approach can minimize the need for unnecessary travel, potentially saving substantial amounts of money and fostering a more sustainable work environment.

Impact of Effective CTEM on Overall Business Finances

Effective CTEM has a direct and positive impact on overall business finances. This impact manifests in several key areas, including increased profitability and improved cash flow.

- Reduced travel expenses contribute to increased profitability by freeing up capital for other business priorities. This includes investment in research and development, marketing campaigns, or expansion initiatives. The careful management of travel expenses ensures that resources are allocated effectively.

- Improved cash flow is another key benefit. By effectively managing travel expenses, businesses can improve their cash flow by reducing outflows and ensuring predictable spending patterns. This enhances the company’s financial stability and liquidity.

- Enhanced decision-making capabilities are facilitated by the availability of detailed travel data. This data empowers businesses to make more informed and strategic decisions regarding future travel plans, allowing for more efficient resource allocation.

Compliance and Security

Maintaining compliance and security is paramount in corporate travel and expense management (CTEM). Robust processes and systems are crucial to ensure adherence to regulations, protect sensitive financial data, and mitigate potential risks. This includes establishing clear policies, implementing strong security measures, and training employees on proper procedures.</p>

A strong CTEM framework, when coupled with a proactive approach to compliance and security, minimizes the risk of costly errors, legal issues, and reputational damage.

Importance of Compliance in CTEM, Corporate travel and expense management

Adherence to regulations is essential for maintaining trust with stakeholders, avoiding penalties, and ensuring the integrity of financial records. Non-compliance can lead to significant financial repercussions and damage a company’s reputation. Compliance ensures that all travel and expense activities are conducted within the legal and ethical boundaries set by applicable laws, regulations, and internal policies.

Role of Security in Managing Sensitive Financial Data

Protecting sensitive financial data is critical in CTEM. Security measures must be implemented to prevent unauthorized access, use, disclosure, disruption, modification, or destruction of data. This includes encrypting data both in transit and at rest, employing strong passwords, and utilizing multi-factor authentication. Robust access controls are needed to limit access to sensitive financial information to only authorized personnel.

Common Compliance Regulations Related to Travel and Expense Reports

Numerous regulations govern travel and expense reports, impacting various aspects of the process. These regulations can vary by jurisdiction and industry. Examples include:

- Fair Labor Standards Act (FLSA): Regulations related to employee compensation and expenses, particularly about business travel. Companies must ensure that employees are properly compensated for expenses incurred while on business travel and that such expenses are documented accurately.

- Internal Revenue Service (IRS) regulations: Rules regarding the documentation and reporting of business expenses. These regulations detail the necessary supporting documentation and specific requirements for claiming business expenses.

- Foreign Corrupt Practices Act (FCPA): Rules against bribery and corruption. Companies operating internationally must ensure compliance with FCPA provisions, which often dictate strict rules for expense reporting, particularly in dealings with foreign entities.

- General Data Protection Regulation (GDPR): Rules related to data protection and privacy, particularly relevant for companies handling employee data, including travel records. Ensuring data is stored and handled in a compliant manner is critical.

Security Measures to Protect Sensitive Financial Information

Implementing robust security measures is critical to protect sensitive financial data. These measures include:

- Data Encryption: Encrypting sensitive data both in transit and at rest using industry-standard encryption protocols is a critical security measure.

- Access Control: Implementing robust access control mechanisms to restrict access to sensitive data based on the principle of least privilege. This involves assigning appropriate roles and permissions to employees.

- Multi-Factor Authentication (MFA): Requiring MFA for accessing sensitive data significantly enhances security by adding an extra layer of authentication beyond a username and password.

- Regular Security Audits: Conducting regular security audits to identify vulnerabilities and ensure the effectiveness of security measures. This proactive approach to risk management is critical.

Employee Training and Support

<p>Effective corporate travel and expense management (CTEM) hinges on well-trained and supported employees. Comprehensive training programs and readily available support systems ensure compliance, optimize costs, and enhance the employee experience. Clear communication channels and readily accessible resources minimize confusion and foster a proactive approach to CTEM.

Well-structured training and support programs directly impact the success of any CTEM initiative. They cultivate a culture of understanding and compliance, leading to more accurate expense reports, lower administrative burdens, and ultimately, better financial control.

Need for Employee Training

Robust employee training is essential for adherence to CTEM policies and procedures. This training ensures employees understand the company’s expectations, guidelines, and limitations regarding travel and expenses. This knowledge equips them to make informed decisions, report accurately, and avoid potential issues or penalties.

Effective Employee Support for CTEM Systems

Providing readily available support for using CTEM systems is critical. Clear documentation, helpful FAQs, and readily accessible technical support channels empower employees to use the system efficiently and effectively. This proactive approach minimizes frustration and errors, leading to more accurate and timely expense reports.

Basic Training Module for New Employees

A basic training module for new employees should cover essential aspects of the CTEM process. This includes a clear overview of the company’s travel policy, guidelines for expense reporting, and an introduction to the designated CTEM system.

- Policy Overview: The module should include a summary of the company’s travel policy, outlining permissible travel methods, pre-approval requirements, and expense limits. This section should highlight key policies, such as the allowance for personal expenses or when pre-approval is necessary.

- Expense Reporting Process: The module should detail the step-by-step process for submitting expense reports, including required documentation, deadlines, and approval procedures. It should include specific examples of acceptable receipts and a clear explanation of what is not acceptable.

- CTEM System Introduction: A hands-on demonstration of the CTEM system is essential. This should include how to log in, submit expenses, and track report status. The training should demonstrate how to utilize any available features of the system, including searching, filtering, and exporting data.

- Contact Information: Providing readily available contact information for the CTEM team or designated support personnel is critical for addressing any queries or issues during the reporting process. This includes phone numbers, email addresses, and a dedicated support website.

Effective Employee Communication Strategies

Effective communication regarding CTEM is crucial. Regular updates, clear communication channels, and accessible resources facilitate understanding and compliance.

- Regular Newsletters/Bulletins: Issuing regular newsletters or bulletins with updates on CTEM policies, system improvements, and frequently asked questions is beneficial. These updates can also address common errors or concerns, helping employees understand potential pitfalls.

- Dedicated FAQ Page: A dedicated FAQ page on the company intranet or portal provides readily accessible answers to frequently asked questions about CTEM. This self-service approach allows employees to resolve issues independently.

- Training Sessions and Webinars: Regular training sessions or webinars covering updates and new features of the CTEM system empower employees to stay informed and compliant. This could include workshops on new policies or system upgrades.

- Feedback Mechanisms: Establishing clear channels for employee feedback on CTEM policies and procedures allows for continuous improvement and adaptation. This can involve surveys, suggestion boxes, or dedicated feedback forms.

Future Trends in CTEM: Corporate Travel And Expense Management

Source: kissflow.com</p>

Corporate Travel and Expense Management (CTEM) is constantly evolving, adapting to changing business needs and technological advancements. This dynamic landscape presents both challenges and opportunities for organizations seeking to optimize their travel programs and expense processes. Key emerging trends in CTEM are driving significant transformations in how companies manage their travel and expenses.

AI and Automation in CTEM

Artificial intelligence (AI) and automation are rapidly reshaping the CTEM landscape. AI-powered tools are becoming increasingly sophisticated in automating tasks such as expense report processing, travel booking, and policy compliance checks. This automation reduces manual effort, minimizes errors, and accelerates the entire process. Machine learning algorithms can analyze historical data to predict travel costs, optimize routes, and identify potential fraud.

Impact of Remote Work on CTEM Strategies

The rise of remote work has fundamentally altered the way companies approach CTEM. Traditional travel policies need to be adapted to accommodate the increased use of virtual meetings and remote collaboration tools. Organizations are now focusing on providing flexible travel and expense policies that support remote employees while ensuring compliance and cost control. This often involves the development of clear guidelines for virtual meetings, reimbursement policies for home office expenses, and the adoption of new expense reporting tools that can handle remote work-related costs.

Innovative Approaches to Expense Management

Companies are exploring innovative approaches to expense management, seeking to enhance transparency, improve employee experience, and streamline the entire process. One notable approach is the integration of mobile expense reporting apps, which allows employees to submit receipts and track expenses in real time. Another trend is the implementation of AI-powered expense report analysis tools, which can automatically categorize expenses and flag potential issues. The integration of these technologies allows for more effective monitoring and management of expenses, providing insights into spending patterns and helping identify areas for cost savings. Examples of innovative solutions include using blockchain technology for secure receipt storage and verification, as well as integrating expense management with other corporate systems, like payroll.

Case Studies and Real-World Examples

Implementing a robust Corporate Travel and Expense Management (CTEM) system can significantly benefit organizations, streamlining processes, reducing costs, and enhancing compliance. Real-world examples highlight the diverse challenges and opportunities inherent in these implementations, offering valuable lessons for businesses contemplating such changes.

A Successful CTEM Implementation at Acme Corporation

Acme Corporation, a mid-sized technology firm, successfully transitioned to a new CTEM system, achieving notable improvements in efficiency and cost savings. Before the implementation, Acme relied on manual expense reports, leading to significant delays in processing and potential errors. The new system automated expense reporting, enabling employees to submit reports electronically and managers to approve them swiftly. This automation reduced processing time by 75% and significantly decreased the incidence of errors. The new system also integrated with Acme’s existing accounting software, providing real-time visibility into travel and expense data. This improved financial reporting and allowed for more accurate budget forecasting.

Challenges and Benefits of CTEM Implementation

Implementing a CTEM system presents several challenges, including employee resistance to change, integration complexities with existing systems, and the need for comprehensive training. Acme Corporation faced initial resistance from employees accustomed to the old manual process, requiring extensive training and support. However, the company addressed this by offering clear communication, providing accessible resources, and demonstrating the system’s benefits. The key benefits of the new system were evident in reduced administrative overhead, improved expense accuracy, and the potential for significant cost savings. These benefits directly impacted the company’s bottom line and contributed to its overall financial performance.

Impact on Operations

The implementation of the new CTEM system had a profound impact on Acme Corporation’s operations. The automated reporting process streamlined the expense approval workflow, reducing delays and enhancing operational efficiency. Real-time expense data visibility empowered management to make informed decisions regarding travel budgets and optimize resource allocation. The new system also fostered better financial control, leading to a more efficient and transparent expense reporting process.

Successful CTEM Strategies Across Industries

Different industries have employed diverse strategies for effective CTEM implementation. In the healthcare sector, emphasis is often placed on compliance with strict regulations, while in the retail industry, efficiency in expense tracking is prioritized. Airlines, for instance, prioritize data analytics to optimize fuel costs and operational efficiency. These varying priorities highlight the need for tailoring CTEM strategies to specific industry requirements.

- Retail Industry: Focus on streamlining expense reporting to quickly track and analyze sales data, ensuring alignment with sales and marketing efforts.

- Healthcare Industry: Emphasis on compliance with HIPAA regulations and adhering to strict guidelines for reimbursement claims, ensuring accurate and timely expense reporting for staff.

- Technology Sector: Prioritizing efficient expense tracking and cost control, especially for project-based work, and utilizing cloud-based solutions to facilitate seamless data sharing and collaboration.

Ultimate Conclusion

In conclusion, corporate travel and expense management is a vital component of any successful organization. By implementing a well-designed system, companies can optimize travel budgets, ensure compliance with regulations, and enhance employee satisfaction. The integration of technology, clear policies, and dedicated employee training are critical to achieving cost-effectiveness and security in this area. Future trends, such as AI and automation, will further shape the evolution of CTEM, driving efficiency and cost savings. Ultimately, effective corporate travel and expense management empowers businesses to operate efficiently and profitably while adhering to ethical standards.