Delta SkyMiles Business Credit Card Maximizing Travel Rewards

Delta SkyMiles credit card business offers a powerful way for business travelers to earn and redeem miles for flights and travel experiences. This comprehensive guide explores the various options, benefits, and financial advantages, helping you decide if a Delta SkyMiles business card is right for your company.

From earning mileage on everyday business expenses to accessing exclusive travel perks, this guide delves into the intricacies of the Delta SkyMiles business credit card program. We’ll analyze earning structures, redemption options, travel benefits, and financial considerations to help you make informed decisions.

Introduction to Delta SkyMiles Credit Card Business

Delta SkyMiles credit cards for business offer a compelling suite of benefits designed to cater to the unique needs of frequent business travelers. These cards reward spending on business-related expenses while providing valuable travel perks that can significantly reduce the cost of corporate travel. By accumulating SkyMiles, businesses can potentially save substantial sums on future trips.

These cards are not just about accumulating miles; they are about streamlining business travel and maximizing rewards. The tailored benefits, such as increased earning rates on specific business spending categories and priority access to airport amenities, directly translate into cost savings and increased productivity for the business user.

Delta SkyMiles Business Credit Card Options

Delta offers a range of business credit cards, each with a unique set of features and benefits. These options cater to diverse business needs, from small startups to large corporations. Understanding the differences between the cards is crucial to selecting the best fit for your company’s travel patterns and spending habits.

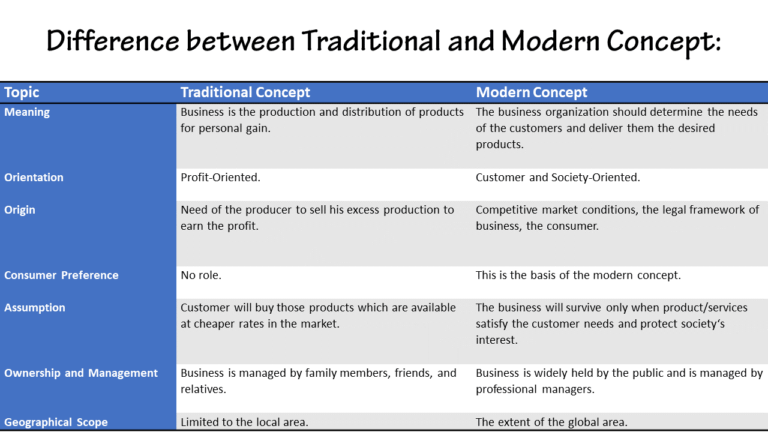

Comparison of Delta SkyMiles Business Credit Cards

The following table compares key features of different Delta SkyMiles business credit cards, helping businesses choose the card best suited to their needs.

| Card Name | Earning Rate | Annual Fee | Travel Benefits |

|---|---|---|---|

| Delta SkyMiles® Business American Express Card | 1.25 miles per dollar spent on Delta purchases and 1 mile per dollar spent on other purchases. | $95 | Priority boarding on Delta, Delta SkyMiles Medallion benefits, and access to Delta Sky Clubs. |

| Delta SkyMiles® Business Card | 2 miles per dollar spent on Delta purchases and 1 mile per dollar spent on other purchases. | $95 | Priority boarding on Delta, Delta SkyMiles Medallion benefits, and access to Delta Sky Clubs. |

| Delta SkyMiles® Gold Business Credit Card | 3 miles per dollar spent on Delta purchases and 1 mile per dollar spent on other purchases. | $250 | Priority boarding on Delta, Delta SkyMiles Medallion benefits, and access to Delta Sky Clubs. Includes other benefits like lounge access. |

Earning and Redemption of Miles

Source: bankdealguy.com

Unlocking valuable travel rewards is a key benefit of the Delta SkyMiles Business credit card. This section details how your business spending translates directly into valuable SkyMiles and how you can redeem those miles for incredible travel experiences.

The program offers a sophisticated mileage earning structure tailored to business needs, allowing you to accumulate SkyMiles efficiently on everyday business expenses. This structure is designed to maximize your rewards, making every business transaction a step closer to your next dream getaway.

Mileage Earning Structure for Business Spending

The Delta SkyMiles Business credit card provides a tiered approach to earning miles. Different spending categories are assigned different earning rates, enabling you to maximize your rewards based on your business operations.

- Business travel expenses, such as flights, hotels, and rental cars, generally yield higher earning rates, reflecting the card’s focus on travel rewards. Examples include booking business flights or reserving hotels for conferences.

- Business entertainment, while often necessary for building relationships and closing deals, is also rewarded with a reasonable earning rate. This encourages the productive use of business-related events. Examples include company lunches and client dinners.

- General business spending, like office supplies and software subscriptions, also contribute to your SkyMiles balance, although the rate may be lower than for travel-related expenses. This recognizes the broader range of business activities that contribute to overall success.

How Business Transactions Accrue SkyMiles

Your business transactions automatically accrue SkyMiles based on the designated spending category. For instance, purchases made with the card at eligible merchants are immediately tracked and converted into SkyMiles. The system is designed to be transparent and straightforward, providing real-time updates on your accumulating rewards. This automated process simplifies the entire reward accumulation process, minimizing administrative burden.

Different Redemption Options for Flights and Other Travel Experiences

Redeeming your SkyMiles offers a diverse range of options, catering to various travel preferences and budgets. You can exchange your miles for flights on Delta or partner airlines or other travel experiences like hotel stays or car rentals. This flexibility allows you to customize your travel plans based on your priorities.

- Flights: You can use your miles to book flights on Delta or its partner airlines, including domestic and international routes. Flexibility in booking dates and destinations is key to ensuring you get the most out of your miles.

- Hotel stays: Redeem your miles for stays at various hotels worldwide, giving you options for accommodations that fit your needs.

- Car rentals: Exchange your miles for car rentals, providing mobility and convenience for business trips or leisure travel.

- Other experiences: Delta SkyMiles offers a range of experiences beyond traditional travel, such as cruises or event tickets.

Examples of Business Expenses Translating into Significant Travel Rewards

Significant travel rewards are attainable through consistent and strategic use of the card. For instance, frequent business travel or large expenses, such as conference bookings or client entertainment, can translate into significant savings on future trips.

| Expense Category | Earning Rate | Example Transactions |

|---|---|---|

| Business Travel (Flights, Hotels, Rental Cars) | 1.5-2.0 miles per dollar spent | Round-trip business flights, hotel stays for conferences, and rental cars for business trips. |

| Business Entertainment | 1.0-1.5 miles per dollar spent | Client dinners, company lunches, or networking events. |

| General Business Spending | 0.5-1.0 miles per dollar spent | Office supplies, software subscriptions, or business meals. |

Travel Benefits for Business

This section highlights the key travel benefits designed specifically for business travelers using the Delta SkyMiles credit card. These perks enhance the overall experience and optimize productivity during business trips. We’ll explore how these benefits compare to other business credit cards and showcase their practical application.

Business travel often requires a balance of efficiency and comfort. The Delta SkyMiles card, with its tailored travel benefits, can significantly improve the experience for frequent flyers. This section will examine the advantages and explore real-world examples to illustrate how these benefits streamline business journeys.

Priority Boarding and Lounge Access

The priority boarding benefit allows cardholders to board the aircraft earlier than standard passengers. This feature offers a significant advantage in managing time efficiently, particularly during busy travel schedules. The ability to board quickly can translate to more time dedicated to work before or after the flight. Lounge access provides a comfortable and productive environment to prepare for meetings, work on presentations, or simply relax before or after a flight.

Checked Baggage Allowance

The checked baggage allowance is a crucial aspect of business travel. A generous allowance for checked baggage reduces the stress and inconvenience of dealing with excess baggage fees. This is particularly important for business travelers carrying extensive documents, equipment, or personal items.

Comparison to Other Business Cards

The Delta SkyMiles credit card’s travel benefits are often competitive with other business credit cards. The specifics of the benefits, such as the checked baggage allowance and lounge access, should be compared directly to other cards to fully understand their value proposition. Thorough comparison shopping is important to find the best fit for individual business travel needs.

Examples of Optimized Business Travel, Delta skymiles credit card business

The ability to prioritize boarding, utilize a lounge for work or relaxation, and manage checked baggage efficiently can greatly enhance a business trip. Imagine a scenario where a business traveler can quickly board, get to their work destination, and use the lounge to complete critical tasks before a meeting. This allows for a smoother, more productive trip, ultimately benefiting both the traveler and their company. Similarly, the ability to check a large number of bags without incurring excess fees can significantly ease the stress of travel and allow for better time management.

Premium Baggage Allowance

Some Delta SkyMiles business cards offer a premium baggage allowance exceeding the standard. This extra space is invaluable for business travelers who need to transport significant quantities of equipment or materials. The exact baggage allowance is a key factor to consider when choosing a business credit card. This premium allowance helps ensure that business travelers can efficiently transport necessary items without worrying about exceeding baggage limits and incurring extra charges.

Financial Advantages and Considerations

Source: fastly.net

Business owners often seek ways to optimize their travel expenses and maximize deductions. Delta SkyMiles business cards can provide significant financial advantages, but it’s crucial to understand the associated tax implications and how to leverage the card effectively. Proper planning and understanding of the rules are key to realizing the full potential of these cards.

Understanding the financial advantages and potential tax implications of using Delta SkyMiles business cards is essential for maximizing their value and minimizing tax liabilities. The annual fee must be considered against the potential value proposition and rewards earned to determine the overall financial benefit.

Financial Advantages for Business Owners

Business travel expenses can often be significant. Delta SkyMiles business cards can help mitigate these costs through various perks and rewards, such as earning miles on business spending. These miles can then be redeemed for flights, hotels, or other travel-related expenses, effectively lowering the overall cost of business travel. Furthermore, many business cards offer exclusive benefits like priority boarding, lounge access, and checked baggage allowances. These can significantly enhance the travel experience and reduce the stress associated with business travel.

Tax Implications of Using Business Cards

Properly understanding the tax implications of using business cards for business travel expenses is crucial. The deductibility of expenses depends on the specific rules and regulations and varies by jurisdiction. The IRS provides guidelines on what expenses are deductible. It’s important to maintain detailed records of all business-related expenses, including dates, amounts, and purposes, to substantiate the deductions claimed on tax returns.

Relationship Between Annual Fee and Value Proposition

The annual fee associated with a Delta SkyMiles business card should be carefully weighed against the potential value proposition for the business. Consider the amount of business travel, the frequency of travel, and the value of the rewards offered. If a business consistently travels, the potential savings and rewards earned may significantly outweigh the annual fee. Conversely, if travel is infrequent, the card might not provide a sufficient return on the investment. For instance, a business with high travel volume will likely benefit more from a card with a substantial reward program compared to a business with less frequent travel.

Maximizing Financial Returns

Several strategies can maximize the financial returns from Delta SkyMiles business cards. Understanding the specific terms and conditions of the card is critical. Utilizing miles for business-related travel and other eligible expenses can significantly reduce out-of-pocket costs. Also, consider combining the business card with other rewards programs or travel arrangements to gain further benefits.

Table: Potential Tax Implications of Using Business Credit Cards for Travel Expenses

| Type of Expense | Potential Tax Deduction | Examples |

|---|---|---|

| Flights | Generally deductible if directly related to business travel. | Round-trip flights to a business conference, connecting flights required for business meetings. |

| Hotels | Deductible for nights spent on business trips. | Hotel stays overnight during a business trip if the hotel is a necessary business expense. |

| Meals | Deductible for business-related meals, up to a certain amount per meal. | Lunch or dinner meetings with clients or meals during business conferences. |

| Transportation | Deductible if directly related to business travel. | Taxis, ride-sharing services, or public transportation to and from business meetings or events. |

| Other Travel Expenses | Generally deductible if directly related to business travel. | Rental car, parking fees, tolls, baggage fees. |

Customer Service and Support: Delta Skymiles Credit Card Business

Maintaining a positive customer experience is crucial for any business, and the Delta SkyMiles credit card is no exception. Effective customer service ensures cardholders feel supported and valued, facilitating a smoother experience with the card’s features and benefits. Prompt and helpful responses to queries and issues are vital for maintaining loyalty and encouraging continued use of the card.

Customer Service Channels

The Delta SkyMiles credit card offers various avenues for contacting customer support. This comprehensive approach allows cardholders to choose the method that best suits their needs and circumstances.

- Phone Support: Direct phone contact provides immediate assistance. A dedicated phone line is available to handle queries, address concerns, and resolve issues in real-time. This allows for personalized guidance and quick resolution of problems.

- Email Support: Email is a convenient option for inquiries that do not necessitate immediate responses. This channel is useful for questions about account balances, billing statements, or specific benefits. Email support ensures a record of communication for future reference.

- Online Chat Support: Online chat provides real-time interaction with customer service representatives through a secure platform. This option is particularly useful for resolving common issues or clarifying account details quickly and efficiently.

- Support Website: The Delta SkyMiles website provides extensive resources and FAQs to address frequently asked questions. This self-service approach allows cardholders to find solutions independently, saving time and effort.

Efficiency and Effectiveness of Channels

The efficiency and effectiveness of these channels vary depending on the type of inquiry. Phone support is typically most effective for complex issues requiring personalized guidance. Email is ideal for inquiries that do not demand immediate attention. Online chat offers a balance between immediate support and the written record of an email. The support website provides a valuable resource for self-service solutions.

Resolving Issues and Disputes

Delta SkyMiles has a clear process for resolving issues and disputes. Cardholders should follow the steps Artikeld on the website to ensure their concerns are addressed appropriately. This involves contacting customer support, providing the necessary documentation, and following the resolution steps in the cardholder agreement.

Contact Information

The following details provide various ways to reach Delta SkyMiles customer support:

| Channel | Details |

|---|---|

| Phone | (XXX) XXX-XXXX (Number may vary) |

| support@delta-skymiles.com (Example address) | |

| Online Chat | Available on the Delta SkyMiles website |

| Website | www.delta-skymiles.com/support (Example URL) |

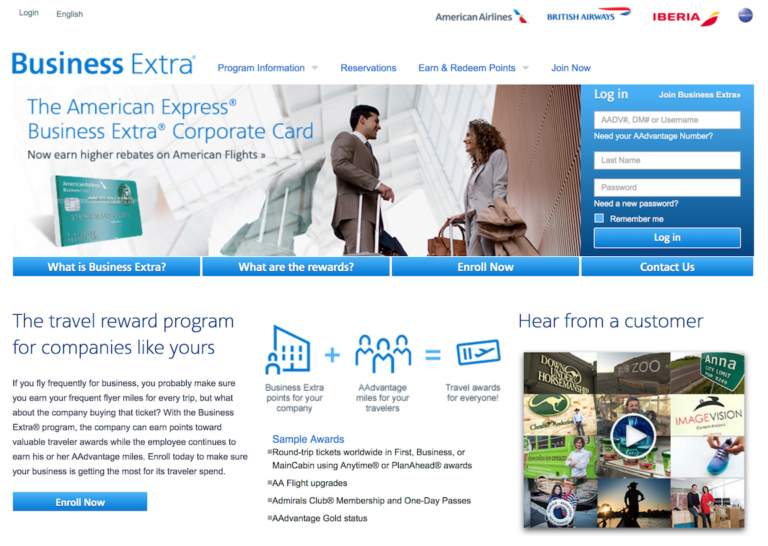

Comparison with Other Business Travel Cards

Choosing the right business travel credit card can significantly impact your bottom line and travel experience. Understanding the nuances of various programs and their benefits is crucial for maximizing your rewards. This comparison explores key features and value propositions of Delta SkyMiles business cards alongside leading competitors.

Competitive Landscape Overview

The business travel credit card market offers a wide array of options, each tailored to different needs and spending habits. Direct competitors to Delta SkyMiles business cards often focus on different reward structures, travel partners, or financial perks. Some prioritize high earning rates on specific spending categories, while others emphasize generous travel benefits and flexible redemption options.

Key Feature Comparison

A comparative analysis of key features provides a clear understanding of the strengths and weaknesses of each card. This table highlights the essential aspects, enabling a direct comparison:

| Feature | Delta SkyMiles Business Card | American Express Business Platinum | Chase Sapphire Preferred Card |

|---|---|---|---|

| Annual Fee | $0 or $95 | $695 | $95 |

| Sign-up Bonus | Variable, often substantial miles based on spending | Points, often substantial, based on spending | Points, often substantial, based on spending |

| Travel Benefits | Delta-branded travel perks, including checked baggage, lounge access | Extensive travel benefits, including lounge access, trip delay/cancellation coverage | Wide range of travel protections and perks, such as trip delay/cancellation insurance and lounge access |

| Earning Rate on Travel Spending | Variable, potentially high, on Delta purchases | Variable, potentially high, on travel purchases | Variable, potentially high, on travel purchases |

| Earning Rate on Other Spending Categories | Generally competitive across spending categories | High earning rate on certain spending categories | High earning rate on certain spending categories |

| Redemption Flexibility | Miles redeemable for Delta flights, hotels, and other Delta-branded partners | Points redeemable for flights, hotels, and other travel partners | Points redeemable for flights, hotels, and various travel partners |

Value Proposition

The value proposition of a Delta SkyMiles business card hinges on your travel patterns and spending habits. If you frequently fly Delta and value Delta-specific benefits, the Delta SkyMiles card is a strong contender. However, if you value a broader range of travel partners or specific spending category bonuses, other options might be more advantageous. Consider your specific travel needs and preferences when making a decision. The annual fee, sign-up bonus, and earning rates all contribute to the overall value proposition.

Factors to Consider

Factors beyond the table, such as redemption flexibility, transferability of points to other partners, and the availability of premium travel benefits should be considered when comparing different business travel cards. The optimal choice depends on individual circumstances and travel patterns.

Business Use Cases and Scenarios

The Delta SkyMiles business credit cards offer substantial advantages for businesses of all sizes. Understanding how these cards can optimize travel expenses and streamline business operations is crucial for maximizing their value. This section details practical applications and real-world examples, demonstrating how the cards can benefit specific industries.

Real-World Examples of Successful Business Card Use

Businesses across various sectors have leveraged Delta SkyMiles business cards to enhance travel efficiency and gain significant financial rewards. A consulting firm, for instance, found that the card’s flexible spending options streamlined its travel and expense reporting processes. This reduced administrative overhead, allowing consultants to focus on client projects. Similarly, a technology startup using the card for employee travel realized considerable savings on airfare and hotel accommodations. These examples showcase how the card can positively impact different businesses.

Optimizing Travel Expenses for a Specific Business

The Delta SkyMiles business card’s benefits can be tailored to optimize travel expenses for various industries. For instance, a consulting firm with frequent international client meetings can leverage the card’s substantial miles earning potential for business class upgrades and frequent travel, saving money on premium travel and improving client impressions. Similarly, a technology firm with geographically dispersed teams can use the card’s earning structure to maximize miles earned on domestic and international travel, effectively reducing overall travel expenses.

Scenarios in the Consulting Industry

The Delta SkyMiles business card presents a powerful value proposition for consulting firms. Consider a scenario where a consultant frequently travels between major US cities for client meetings. Earning miles on every trip allows for potential upgrades to business class, improving the consultant’s comfort and efficiency, thus improving client experience. Further, the ability to earn miles on hotel stays and rental cars can drastically reduce overall travel expenses, which translates into greater profitability.

Scenarios in the Technology Industry

For technology companies with geographically dispersed teams, the Delta SkyMiles business card presents a strong value proposition. Imagine a tech company organizing quarterly meetings for its global teams. The card can help optimize travel expenses by maximizing miles earned on flights, hotel stays, and rental cars. This enables the company to lower travel costs while simultaneously offering employees a more comfortable travel experience. This leads to increased employee satisfaction, which can positively affect productivity and retention.

Ideal Situations for Business Travel and Expense Management

The Delta SkyMiles business cards are particularly beneficial in situations involving frequent business travel. For companies that frequently fly on Delta or its partner airlines, the rewards program offers considerable value. Companies with substantial travel budgets can leverage the card’s potential to maximize their rewards. Furthermore, companies that prioritize expense management and streamlined travel reporting will find the card’s benefits invaluable. These situations highlight the card’s ability to efficiently manage business travel and expenses.

Frequently Asked Questions (FAQs)

Source: moneysmylife.com

This section addresses common questions about Delta SkyMiles business credit cards, providing concise and accurate answers. Understanding these details can help you maximize the benefits and effectively utilize these cards for your business travel needs.

Navigating the specifics of business travel and rewards programs can sometimes be complex. These FAQs aim to clarify key aspects, empowering you to make informed decisions about your business travel expenses and rewards.

Earning Delta SkyMiles

Understanding how to earn Delta SkyMiles is crucial for maximizing the benefits of the card. Earning potential depends on factors like spending habits and card type. The Delta SkyMiles program offers various ways to earn miles, including spending on eligible purchases.

- How many miles can I earn per dollar spent? Earning rates vary based on the specific card and the type of purchase. Refer to the cardholder agreement for detailed information on earning rates. For example, the Delta SkyMiles Gold American Express card may offer a higher earning rate on travel purchases compared to the Delta SkyMiles Platinum American Express card, but the exact amount earned will depend on the individual purchase and its category.

- Are there any restrictions on earning miles? Certain categories of spending may not qualify for mile earning. For example, cash advances or balance transfers typically do not earn miles. Review the terms and conditions of the specific card you are considering to avoid unexpected exclusions.

Redeeming Delta SkyMiles

Knowing how to redeem your earned Delta SkyMiles is important. The program offers flexibility in redemption options, allowing you to tailor your travel plans to your specific needs. Flexibility in redeeming your miles is a significant advantage.

- What are the redemption options for Delta SkyMiles? Miles can be redeemed for flights, hotel stays, and other travel experiences. The specific redemption options and associated fees vary based on the chosen redemption method. This flexibility is a key benefit of the Delta SkyMiles program.

- How do I choose the best redemption option? Evaluate the specific redemption value against the miles you have accumulated. Consider the cost of alternative options like booking directly or through a third-party site.

Business Travel Benefits

These cards offer numerous advantages tailored for business travelers. Specific benefits vary by card type, so careful comparison is essential. Many business travelers find that the benefits are tailored to their specific needs.

- What are the specific travel benefits for business travelers? This includes benefits like priority boarding, access to airport lounges, and travel insurance. Review the benefits associated with the specific card to ensure they align with your travel needs. Examples include Delta SkyMiles Gold, Delta SkyMiles Platinum and the Delta SkyMiles Business.

- Do these benefits apply to all business trips? Terms and conditions vary by card and trip type. Confirm eligibility with Delta SkyMiles customer service or the cardholder agreement.

Financial Advantages and Considerations

Understanding the financial implications of using a Delta SkyMiles business credit card is crucial. Weigh the benefits against potential drawbacks before making a decision. This will help you make informed decisions.

- What are the fees associated with the Delta SkyMiles business credit card? Fees can include annual fees, foreign transaction fees, and interest charges on outstanding balances. Review the complete fee structure before applying for a card. It is vital to carefully consider the fee structure to avoid unnecessary costs.

- Are there any creditworthiness requirements for applying? Creditworthiness requirements vary based on the specific card. Review the eligibility criteria to ensure you meet the requirements.

Comparison with Other Business Travel Cards

Comparing Delta SkyMiles cards with other business travel cards is a key step in making an informed decision. Consider the value proposition offered by other programs. Different programs offer various benefits, so comparison is essential.

| Feature | Delta SkyMiles Business Card | Other Business Travel Card |

|---|---|---|

| Earning Rate | (Specific Rate) | (Specific Rate) |

| Travel Benefits | (Specific Benefits) | (Specific Benefits) |

| Fees | (Specific Fees) | (Specific Fees) |

Thorough comparison is crucial for identifying the best fit for your business travel needs.

Final Summary

In conclusion, the Delta SkyMiles business credit card provides a robust system for maximizing travel rewards for business trips. Understanding the various card options, earning potential, and travel benefits is key to maximizing financial returns and optimizing business travel experiences. By considering the potential tax implications and comparing them with other business travel cards, you can make an informed decision on whether this program aligns with your company’s travel and expense management needs.